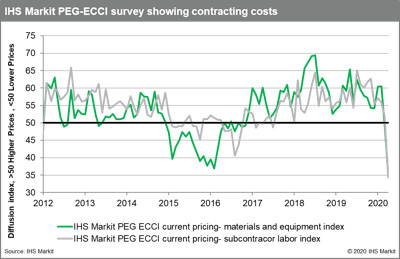

After 41 consecutive monthly increases, engineering and construction costs fell in April, according to IHS Markit and the Procurement Executives Group (PEG). In the survey comments, respondents attributed lower demand conditions to the novel coronavirus (COVID-19).

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 34.9 in April, after staying barely neutral in March. The materials and equipment portion of the index came in at 35.2 and the subcontractor portion came in at 34.3; any figure below 50 indicates falling prices.

The materials and equipment sub-index recorded both the second consecutive month of falling prices and an all-time low. Survey respondents reported falling prices for 11 out of the 12 components with only ready-mix prices coming in at neutral. Index figures for all categories dropped relative to March, indicating that a greater proportion of the respondents are observing lower prices.

With the exception of exchangers, all equipment categories moved from increasing prices in March to falling prices in April. For categories such as fabricated steel, alloy steel pipe and carbon steel pipe, April’s diffusion index reading was the lowest since the survey started in 2012. This does not mean that respondents saw the lowest prices in April, merely that most companies surveyed observed falling prices.

“The sharp decline recorded in the index highlights the rapid deterioration in the U.S. economy and, more specifically, in the energy industry since January,” said John Mothersole, director of research at IHS Markit pricing and purchasing. “IHS Markit does see a bottom for oil prices in the second quarter. This said, the recovery in the U.S. economy looks to be sluggish and extend well into 2021.”

The sub-index for current subcontractor labor costs came in at 34.3 in April. Responders had noted rising prices in March, with an index figure of 52.0. Labor costs fell in all regions of the United States as well as Canada. Similar to materials and equipment sub-index, this was the lowest ever reading since the survey started in 2012.

After 43 months of consecutive increases, the six-month headline expectations for future construction costs fell in April with an index figure of 42.1, yet another all-time low for the IHS Markit PEG Engineering and Construction Cost Index. Both the materials/equipment and labor subcomponents recorded expectations of future price decreases.

The six-month materials and equipment expectations index came in at 40.7 this month, down from 57.6 last month, with responders expecting falling prices for all categories. Expectations for subcontractor labor slipped to 45.2 in April. While the U.S. Midwest is expected to see higher labor costs in six months, labor costs are expected to stay flat in the U.S. West. Labor costs in Canada, U.S. South and U.S. Northeast are expected to keep falling.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.