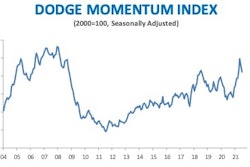

The first six months of 2021 saw a 12% upswing in the value of commercial and multifamily construction starts in major U.S. metropolitan areas vs. the first half of 2020. The latest statistics from Dodge Data & Analytics also show construction starts in both segments were up nationally by 10% on a year-to-date basis.

Commercial and multifamily is comprised of office buildings, stores, hotels, warehouses, commercial garages and multifamily housing. Not included in the ranking are institutional projects, manufacturing buildings, single-family housing, public works and electric utilities/gas plants.

In the top 20 metro areas, the value of commercial and multifamily construction starts were up 12% in 2021's first half. Among the top 10 metros, also up 12% as a whole, only Washington, DC, Los Angeles, CA, and Austin, TX, posted declines. Those in the second-largest group (ranked 11 to 20) saw starts improve by 11% overall for the first six months, with only Phoenix, AZ, Houston, TX, and Chicago, IL, showing decreases.

The early months of the pandemic led to construction moratoriums and project delays in many of the country's largest cities, resulting in very low levels of activity in April and May 2020, Dodge Data points out. If the current results are compared to the first six months of 2019 – absent pandemic-related influences – commercial and multifamily starts for 2021’s first half were down 9% in the top 20 metro areas and 5% on a national basis, indicating the pandemic had the greatest impact on construction activity in larger cities. Starts in the top 10 metro areas were 20% lower and those in metro areas ranked 11 through 20 were down 13% vs. the first six months of 2019.

Rankings by Metro Area

As in 2020, the top 10 metro areas accounted for 40% of all U.S. commercial and multifamily starts. They were led in value by New York, NY, at $12.6 billion (+8%) and Dallas, TX, at $4.5 billion (+12%). Those posting the greatest percentage gains in the first half of 2021 included Philadelphia, PA, up 86% at $3.3 billion, and Seattle, WA, which rose 61% at $3.2 billion. The remainder of the top 10 included:

- Washington, DC - $4.3 billion (-7%)

- Boston, MA - $4.0 billion (+34%)

- Miami, FL - $3.5 billion (+26%)

- Los Angeles, CA - $3.4 billion (-22%)

- Atlanta, GA - $2.5 billion (+2%)

- Austin, TX - $2.5 billion (down less an 1%)

For the full breakdown by top 10 metro area, click here.

The second largest group of metro areas accounted for 18% of all U.S. commercial and multifamily starts year-to-date, comparable to the prior year. This group was led in value by Phoenix, AZ, at $2.5 billion (-10%) and San Diego, CA, which at $2.2 billion saw a whopping 171% leap from the same period in 2020. Other metros seeing sizable gains included San Francisco, CA, at $1.9 billion (+114%); Minneapolis, MN, at $1.7 billion (+71%); Denver, CO, at $2.1 billion (+64%); and Kansas City, MO, at $1.6 billion (+60%). Finishing off the list were:

- Houston, TX - $2.2 billion (-30%)

- Nashville, TN - $2.0 billion (+53%)

- Chicago, IL - $1.9 billion (-54%)

- Orlando, FL - $1.5 billion (+11%)

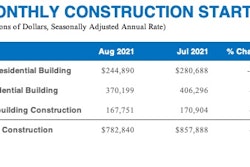

Starts at the National Level

Through the first six months of 2021, total U.S. commercial and multifamily building starts rose 10% to $108.5 billion from the same period of 2020, Dodge Data reports. Nationally, commercial starts were up 3% to $56.1 billion, while multifamily starts were 19% higher at $52.4 billion on a year-to-date basis.

Within the top 10 metro areas, commercial building starts were 1% higher at $20.6 billion through six months, while multifamily building starts were up 23% to $23.3 billion. Within the second largest group of metro areas, commercial starts dipped 3% to $9.8 billion and multifamily starts rose 30% to $9.9 billion.

Richard Branch, Dodge Data chief economist, describes the recovery from the COVID-19 pandemic as uneven. "Commercial construction has been buoyed by strength in the warehouse sector as large e-commerce companies build out their logistics infrastructure, while office, retail and hotel activity is subdued. Multifamily starts, meanwhile, have rebounded solidly following a weak 2020,” he noted.

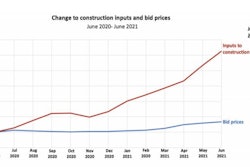

Though Branch anticipates the dollar value of commercial and multifamily starts to continue to improve over the coming six months, he cautions that “growth will remain muted due to high material prices and a shortage of skilled labor in the construction sector.”

Information provided by Dodge Data & Analytics and edited by Becky Schultz.