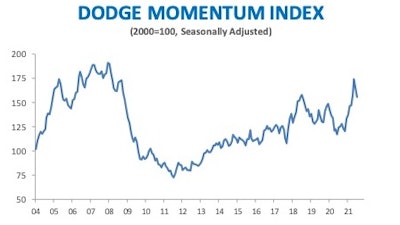

Higher prices for materials and ongoing labor shortages continue to place pressure on commercial and institutional planning, causing the monthly Dodge Momentum Index to slide for a second consecutive month. The Index fell 6% to 155.8 (2000=100) in July, a nine-point dip from the June reading.

The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Both components of the Index fell in July, with commercial planning down 3% and institutional planning down 9%, as both ongoing material shortages and difficulties in attracting and retaining skilled workers negatively impacted project costs.

Even with the declines in June and July, Dodge Data notes the Momentum Index remains near levels last seen in 2018. The July reading is 25% above July 2020, with institutional planning up 27% and commercial planning up 25% by comparison.

Nonresidential construction starts thus far this year reflect some of the earlier planning gains. According to a July 27 report released by Dodge Data, the first six months of 2021 saw a 12% upswing in the value of commercial and multifamily construction starts in major U.S. metropolitan areas vs. the first half of 2020, with construction starts in both segments up nationally by 10% on a year-to-date basis.

And while somewhat muted compared to earlier this Spring, 11 major projects entered planning in July, including:

- a $240 million Microsoft Data Center in San Antonio, TX

- a $200 million Amazon, Inc. fulfillment center (Project Basie) in Woodburn, OR

- a $225 million Baptist Health Hardin Medical Pavilion in Elizabethtown, KY

- the $200 million AdventHealth Narcoossee campus in Orlando, FL

Consequently, there is reason for optimism. However, Dodge Data foresees the pressures of higher material prices and labor and skills shortages as likely to continue, and cautions that the rising number of COVID-19 cases caused by the Delta variant raise concerns that the recovery in construction may stall in the months ahead.

Information provided by Dodge Data & Analytics and edited/enhanced by Becky Schultz.