London, Ontario-based Trackunit announced Oct. 9 it had acquired field service and installation provider OEM Solutions Inc. of Oak Brook, Ill. (OEMSI).

This development has real importance for contractors and other equipment fleet owners interested in using telematics, internet of things (IoT) sensors and software to track and manage off-road equipment used in construction. But Trackunit is targeting growth in its solution set as well as in its ability to deliver hardware to off-road equipment fleets, and is also working to get more other software companies to build solutions for its platform and augmenting this expanded capability through acquisition.

Technology vendors like Trackunit, Samsara, Verizon, Geotab, Fleetio and others may provide IoT sensors to gather machine performance and location data, and cloud software to provide visibility and maintenance functionality, but they often rely on third-party installers and service providers for installs and to support sensors and other devices once they are in the field.

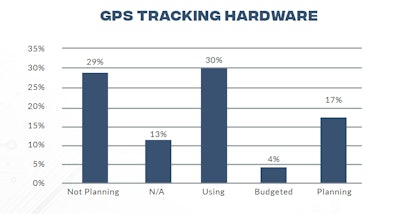

Growing Demand

The deal will help Trackunit meet demand for connected equipment, which is currently the leading equipment technology for investment according to the 2023 State of the Industry Construction Technology Report.

OEMSI’s network of more than 100 installers has recently expanded into Canada. The addition of this team to Trackunit will help the construction-specific GPS-enabled asset management software provider more quickly grow beyond the 1.25 million assets currently tracked in the technology.

Hardware installation capacity can sometimes be a constraint to onboarding new customers, and can sometimes keep smaller GPS-enabled asset management vendors from serving the largest fleets. As we found in an IRONPROS debriefing call with Trackunit Chief Customer Officer Mathias Frost Bilgram in the days before the acquisition was announced, the quality of installation matters almost as much as the quantity of installers available to do the work.

Quantity and Quality of Sensor Installation

“We have typical service level agreements (SLAs) in place which dictate the quality level of installations and the data depth of the installation,” Frost said. “We track our commitments less the forecast or pace of installation, which we may express in a number, for instance we may want to do 10,000 installations next month. The acquisition really, if you think about it, really ties into all of the SLA aspects because it will give the customers faster installations, because we can route supply demand much more effectively and efficiently … To do an installation, basically, you need a machine that's not connected, then you need the stuff to connect it and you need the personnel to do the connection. If you have those three things, you can perform the installation.

“The second piece is that we're going to improve is quality. Do you get the right data off the machine, and that's the big pain point today. When our customers are using third party companies, some of them being not as deep in the domain expertise as we are, you figure out that holy moly, that installation was not done in the right way---it’s not wired in the right way to enable the use cases and the features you actually based your investment on. So by doing this, we're actually going to infuse that domain expertise into our installations to a much higher degree, which means that the customers will get more data off the machines.”

According to Frost, Trackunit will roll out to OEMSI technicians their pre-existing certified installer program.

“We want to make sure the installers have the skills to perform different types of installations ranging from simple two-wire connections to very advanced four-wire connections that tap into the CAN bus and internet for access management or relays of the machine,” Frost said.

Increasing initial quality of the installation will reduce the need to roll a second truck, which improves customer experience and lowers cost for Trackunit.

This user experience is delivered by an Uber-like application, according to Frost,

“Right now, Trackunit has a piece of technology that the installers use in the field for grabbing jobs, performing jobs and certifying that the jobs have been carried out successfully,” Frost said. “That's where the installers are scheduled for the day, and where the customers put in the jobs to make everything coordinated, tracking it centrally. Folks who are engaged with Trackunit are going to be having the same experience, but they're just going to have access to a greater network of gig workers who can execute and will be exclusively doing this for Trackunit.”

But in addition to quality, size matters according to Frost.

“We're going to grow the installation network,” Frost said. “We aspire to create the biggest global network of installation technicians, for our for the off-highway industry.”

Extending Trackunit with More Solutions

While Trackunit has opted to acquire OEMSI to grow its install base, it is extending its software both by acquisition and through partnerships. Product partnerships will be boosted by a development platform built into the Trackunit product set.

“Right now we’re in the midst of launching the Trackunit Software Development Kit (SDK) along with the Trackunit Marketplace later this year,” Trackunit Senior Vice President of Product David Swan said. “What that means is that any industry partner will have the opportunity to actually build on our (platform) and IoT device setup. That means they can build their own digital solutions that live in the Trackunit user interface and on the Trackunit platform but at the same time solve very specific problems that they are out to solve.”

In early 2023, Trackunit also announced the acquisition of field productivity software solution Flexcavo, which prior to the deal had a pre-existing integration with Trackunit.

The deal brought Trackunit enhanced capabilities to help contractors and other equipment fleet owners build automated workflows around equipment data to inform dispatching, scheduling and maintenance. Trackunit CEO Soeren Brogaard and Flexcavo Founder Benedict Aicher described in a debriefing with IRONPROS how Trackunit will use its North American sales channel to sell the Flexcavo solution to its established account base and new accounts, making for more direct competition for vendors like Equipmentshare, Tennna, Assignar and Raken.

“We solve a couple of problems people experience when owning machines—problems that come up around demand and supply,” Aicher said. “We start with project demand generated by construction type and then help the contractor make most of their fleet by balancing machine supply and demand for equipment. Demand and supply for equipment is very complex when all the system stakeholders are involved in order to balance owned equipment and rented equipment with project needs.”