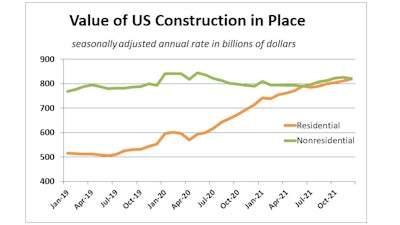

The total value of construction put in place in December inched up just 0.2%. But total spending for the year jumped 8.2% and is about 14% greater now than at the pre-pandemic peak early in 2020.

The slight gain in total construction outlays was owed entirely to a 1.1% increase in residential spending. Nonresidential spending fell 0.7% in December, ending a streak of five monthly gains.

A key difference between construction spending in 2021 and early 2020, is that residential spending has soared nearly 60% over that time to equal what is normally an industry-dominant nonresidential spending total. Nonresidential construction spending in December was just 3.2% ahead of its pre-pandemic peak.

To get a sense for the scale of residential construction spending’s climb, December’s $819.1-billion seasonally adjusted annual rate is nearly 22% greater than at the 2006 peak of the pre-Great-Recession housing bubble.

Nonres is likely worse than it looks

Nonresidential spending’s slip in December ended a five-month streak of gains. Monthly spending was down in 11 of the 16 nonresidential subcategories. Private nonresidential data: US Department of Commerce; table: ForConstructionPros.com

data: US Department of Commerce; table: ForConstructionPros.com

“Much of the increase in nonresidential construction spending is attributable to inflationary pressures, not actual increases in physical output,” said Associated Builders and Contractors Chief Economist Anirban Basu. “The fact that nonresidential spending was down in December despite rising labor costs and elevated materials prices does not bode well for near-term profitability.

“A few segments continue to create a disproportionate share of contractor opportunities. Among those are the commercial segment, which includes construction of fulfillment centers and manufacturing, a segment in which construction spending has expanded more than 30% during the past year.

Total construction spending jumped 8.2% in 2021, and is about 14% greater now than at the pre-pandemic peak early in 2020.data: US Department of Commerce; graph: ForConstructionPros.com

Total construction spending jumped 8.2% in 2021, and is about 14% greater now than at the pre-pandemic peak early in 2020.data: US Department of Commerce; graph: ForConstructionPros.com

Mark Vitner, senior economist with Wells Fargo Securities, says conditions are right for public construction to come back strong when the federal monies do start to flow.

“Despite recent weakness, public construction is poised for stronger growth over the next few years. State and local governments are flush with cash from strong tax receipts and previous rounds of federal aid. Much of this spending is going into street improvements, greenways and streetscapes.”

Residential remains a phenom

“Residential construction also continues to be a hot spot in an environment characterized by scant inventory of unsold homes and rapidly rising rents, and the strength of multifamily construction is arguably one of the most surprising aspects of the economic recovery,” said Basu. “Overall, contractors remain confident about the next six months, according to ABC’s Construction Confidence Index.”

Residential spending rose 1.1% during December, with a nearly 23% leap in unadjusted spending over the full year.

Single-family outlays climbed 2.1% in December.

“Demand for new homes remains robust in the face of fast-rising home prices and modestly higher mortgage rates,” said Vitner. “A brief respite in lumber prices appears to have provided a boost to home construction last fall, but prices have since spiked as inventories grew tight again.”

Multifamily spending increased 0.4% during the month.

“Apartment vacancy rates have fallen sharply, as rental demand has exploded alongside shrinking single-family inventories,” said Vitner. “The recent upshift in multifamily permitting suggests spending on apartment and condo construction should continue to rise, albeit somewhat more modestly than this past year.” data: US Department of Commerce; graph: ForConstructionPros.com

data: US Department of Commerce; graph: ForConstructionPros.com