By Larry Stewart, Editor, ForConstructionPros.com

“If you’re in a leadership position, relationships are your No. 1 thing,” says Mike Twedt, East Region Equipment Manager for pipeline company Minnesota Ltd. “That’s how we function as successful business people, building every relationship you can as positively as possible.”

Minnesota Limited is a pipeline contractor headquartered near Minneapolis doing business across 25 different states in the U.S.

Minnesota Limited is a pipeline contractor headquartered near Minneapolis doing business across 25 different states in the U.S.

The Association of Equipment Management Professionals (AEMP) coined the phrase Equipment Triangle in 1995 as the cornerstone of association members' philosophy of building mutually beneficial relationships between equipment users, distributor/dealers and manufacturers or suppliers. The Triangle philosophy reminds industry professionals that in this multi-tiered relationship “everyone is entitled to receive the respect they deserve, and all transactions are to be win-win for all concerned.”

The Triangle underscores that AEMPs Standards of Ethical Conduct should govern the actions of everybody approaching a relationship from the three sides of the equipment triangle.

“[A Triangle relationship] is a lot of tag teaming,” says Ernie Stephens. “Might be us and the dealer meeting the OEM or us and the OEM working with the dealer. In both cases, we’re able to rely on someone in the party.

“Sitting down with contacts on every leg of the triangle really helps. You’ve got to give them a seat at the table [to excel in equipment management]. I don’t think it’s done enough.”

Industry willingness to throw resources at problems without getting input that might help prevent recurrence was part of the motivation for codifying the Equipment Triangle. The philosophy reminds equipment professionals that each is working through a partnership to achieve their own ends and help the other partners succeed.

“The manufacturer knows who we are, we trust our dealer and our dealer is going to bat for us,” says Twedt. “It builds the relationships and, I think, impacts how we are treated. I think they give us great deals and great service.”

Triangle language recognizing that transactions need to be a win for all three sides doesn’t necessarily mean every transaction.

“Whether somebody else makes money is not in the front of mind when I’m looking at deals trying to take care of my company,” says Twedt. “I expect them to take care of themselves, and I’m OK with that as long as I’m also making a great deal.

“It’s a mutual thing, and that just comes from discussion. The relationship is particularly important in these deals because we can talk candidly. I say, ‘Hey can you come down this much?’ and if the answer is ‘Well, no. I’d only be making this much and I have to do better than that,’ well, I’m OK with that.”

Acknowledging the long-term value each member offers makes taking “no” for an answer easier to do.

“When it comes to equipment purchasing, the No. 1 issue is purchase price,” says Twedt. “You have a budget and X amount of equip you have to have. You have to get the best bang for your buck.

“Of almost equal importance, though, is the vendor’s service capability. I buy Caterpillar and John Deere because we’ve got established relationships with good dealers and they’ve got dealers in all of the areas where we work. So I know if I have an issue, there’s a dealer right down the road that is going to be able to take care of us.”

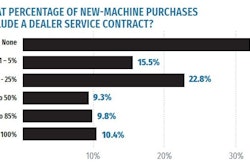

Signing service contracts is a measure of a contractors’ appreciation of the value of their dealers’ capabilities, and negotiating the terms can prove of how willing a contractor, dealer and manufacturer are to work together to foster all three parties’ success.

“We’re growing. I’ve probably added $40 to $50 million in equipment to the Superior fleet [over the past few years],” says Stephens. “I was able to leverage those purchases to add on 70 to 80 maintenance packages from the vendors, and that’s been a huge relief.

“It may cost a little more up front, but we need to stick with what we’re good at – we should be doing the inspections and the preventative side. If you need to get a laptop out to troubleshoot, it’s time to get the dealer involved. The dealers are getting training that our guys will probably never get.”

Stephens limits his service-contract business to dealers and vendors who understand the Triangle concept.

“We’ve been picky about who we’ve tried to do those large packages with. You’re going to get a better deal giving them a bulk package, and I think it’s worked out good for both of us,” he says. “If we’re growing and doing all the taking, and winning every time [on the purchase, warranty, parts, labor costs and more], dealers are going to suffer. You’ve really got to allow them to grow with you.

“And you really set up a good priority level for your company at the dealer because you’re already doing so much business with these people. They know that if something bad happens they need to be out there right away, and typically your name’s at the top of the list.”

Stephens and Twedt are also both testing boundaries of heavy equipment leases.

“There’s other ways of sourcing your equipment, and there’s no better choice than leasing right now, whether it’s short- or medium-term,” says Stephens. “It almost acts like a rental but with a substantially better rate. The jobs are happy and you’re not spending too much capex, so your bonding companies are happy and you’re able to bid more work.”

Leases can be contractual proof of how willing a contractor, dealer and manufacturer are to work together for all three parties’ success. Vendors share some of the long-term risk of equipment ownership with an equipment lessor. The leased machine is likely to return to the dealer’s inventory, and a properly negotiated lease gives the dealer and manufacturer incentive to make sure its resale value reaches the estimate used in calculating lease terms. It motivates vendors to make service contracts attractive to the equipment user.

The volume of Stephens’ leasing and service agreements allowed him to negotiate most elements.

“We have pre-arranged discounts on parts, and when you’re throwing that much labor at them, we negotiate that labor rate.

“My idea was for them to get out there and put their hands on it; do the service at a very economical price for both of us, and while they’re out there, do the undercarriage inspections, check the cutting edges, and whatever else might be necessary to keep the machines reliable,” Stephens says. “That’s where they’re going to make their money.

“It’s a long-term commitment. That’s what they want at the end of it. A service contract is a valuable thing to share with the vendor.

“When you put everyone’s ideas in the same bucket, you’ll see it’s not just you winning; it’s everyone winning. I’m going to get the best price I can – the lowest price on the best machine – and they’re going to win on the back side, getting the parts and service business and the brand exposure to other equipment buyers.”

Superior Construction has reaped enough value from leases and service contracts – alternatives often considered too expensive by many equipment users – that they’re changing the way they determine equipment needs and fill them. Stephens again finds making that process easier for dealers and manufacturers yields plenty of benefit for Superior.

“We’re in our second generation of jobsites projecting equipment schedules, especially when we win a job,” he says. “So up here in the Midwest, come December or January, we have a good idea what we will need for the season come March, April, May.”

Pushing project managers to forecast equipment needs has great budgeting value for the contractor, and sharing the information with the company’s trusted Equipment Triangle business partners not only returns more value, but spreads it around to the dealers and manufacturers.

“Dealers have to order equipment three to five, if not more, months ahead. So better lead time is really advantageous for them.”

And advantageous for Superior.

“Last year, I needed ten 200-sized excavators, half of them with breakers, and four dozers just for this one job. Come May 1, the dealer had all of them sitting on their lot with our name on them,” Stephens says. “Everybody wanted them, but they had our name on them because we asked for them in January.

“We’re really trying to forecast what we’ve got going on for the entire season. Lead time is everything right now with equipment – it’s so hard to find and prices are going up. If you can give a dealer an advantage there by not hiding anything, you’re really helping both parties.”

Forecasting equipment needs and ordering early is a challenging change in equipment buying with benefits for the entire triangle. And customers challenge dealers and manufacturers to test the benefits they might realize from tailoring their sales approach to relationship building.

“When we return equipment, our mainstays take the time to ask if the machine worked out alright, and they take action on our feedback,” says Twedt. “In addition, these guys will also – not frequently because they know we’re busy – if they’re in the area, ask if they can swing by to check in on a piece of equipment out on one of our jobs. If it works out, I appreciate that. They’re wanting to make sure they’re taking good care of us. The dealers that we work with all the time do that regularly.”

“It’s kind a tricky. I don’t want a thousand people blowing me up every day on the phone, calling me up just to see what they can help me out with.

“I understand those times when a salesman is filling a call log, but the guys we’ve got a terrific relationship with, they understand we’re busy and they’re working not just to take me to lunch,” Twedt says. “They’re reaching out to my guys in the field saying, ‘Hey we heard you had an issue. Can we come out and help you take care of that?’

“That’s hugely valuable to me and even our supers and foremen. They don’t like a lot of vendors coming out to the jobs, but when it’s those guys, they don’t mind it. They like it because they know it’s just more help.”