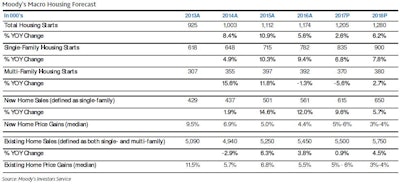

The outlook for the US homebuilding industry remains positive over the next 12 to 18 months, despite recent tax law changes that could negatively impact upscale home buyers and home owners, Moody's Investors Service says in a new report.

"While the new tax laws may affect the upper-end home buyers and owners, there is enough demand strength for less-expensive homes, particularly in first-time homes, to keep the homebuilding industry growing in 2018," says Joseph Snider, Moody's VP-Senior Credit Officer.

The key building blocks of overall home buyer demand — consumer confidence, wage growth, household real income growth, and employment strength — are all at or near longtime highs, adds Snider. Meanwhile, slowly rising mortgage rates and declining affordability are still favorable by historical standards.

Moody's expects states with high state and local taxes ("SALT") and high-priced homes, particularly California and New York, to be disproportionately affected by the tax law changes. The adverse impact on demand in these states may take time to be absorbed, and will likely reduce demand at the upper end.

However, a reduction in demand could be partially offset by behavioral changes, notes Snider. For example, the lowering of the mortgage-interest deduction may make current owners of homes with high mortgage balances less willing to sell because they would lose their grandfathered status, limiting the supply of upper-end homes and strengthening pricing for both new and existing higher-priced homes.

Homebuilders will also benefit from the lowering of the corporate income tax assessment to 21% from 35%, as the sizable savings may permit them to offer incentives at the upper end to offset some of the headwinds from the new tax bill, says Moody's. The majority of builders will not feel the impact of the 30% limitation on the deductibility of corporate interest expense because they are not highly levered.