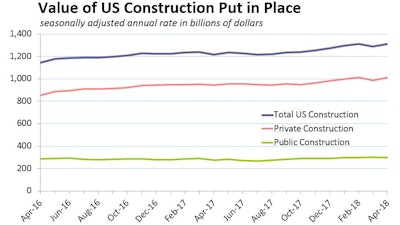

The total value of U.S. construction Private-sector expenditures rose 2.8% during April, while public-sector spending fell 1.3%.

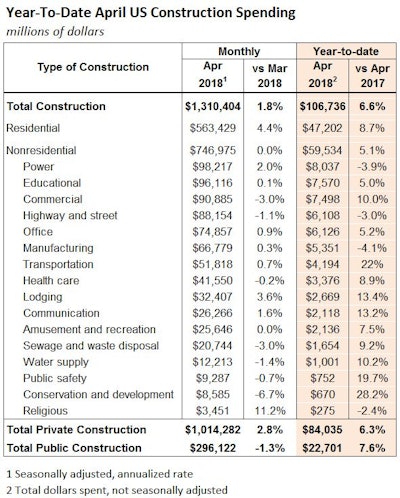

Private-sector expenditures rose 2.8% during April, while public-sector spending fell 1.3%.

“The April jump reversed the March drop, but the bigger picture here is that this is the fifth 1%-plus increase in the past six months,” Ian Shepherdson, chief economist for Pantheon Macroeconomics told MarketWatch. April residential construction spending jumped 4.4% in its biggest gain since 1993.

April residential construction spending jumped 4.4% in its biggest gain since 1993.

Year-to-date spending is 6.6% higher than the same period in 2017.

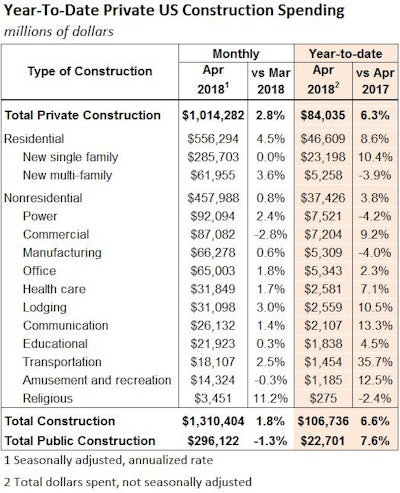

Private-sector expenditures rose 2.8% during April, the largest increase since January 2012. Residential construction spending jumped 4.4% (year to date, now 8.7% greater than in last year’s first four months). It was the biggest rise since November 1993.

Much of April’s residential rebound was due to home-improvement expenditures, which jumped 11.6%, according to Wells Fargo Economics’ analysis of the Commerce Department’s monthly estimates. Outlays for single-family construction were flat in April and multifamily construction increased 3.6%

Spending on nonresidential construction was flat in April, with a 2.0% increase in spending on the massive power segment neutralized by The residential rebound came largely in home-improvement spending, which jumped 11.6%, according to Wells Fargo.

The residential rebound came largely in home-improvement spending, which jumped 11.6%, according to Wells Fargo.

Total nonresidential construction in the U.S. year to date remains 5.1% above spending in the same period of 2017. Power construction spending is down 3.9% year to date, highway and street construction is down 3.0% and the manufacturing sector has spent 4.1% less than in the first four months of 2017. But the other large nonresidential sectors have shown strength so far in 2018:

- Educational +5.0%

- Commercial +10.0%

- Office +5.2%

- Transportation +22.0%

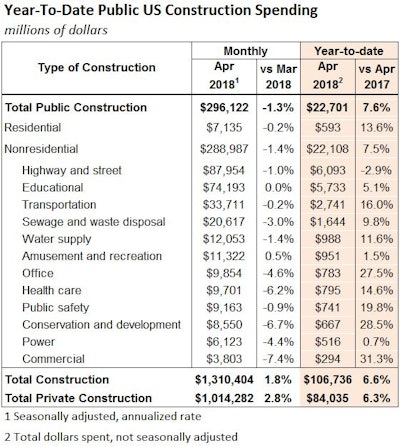

Public-sector spending fell 1.3% on a 10.2% plunge in federal spending and 0.3% slip at the state and local level. The largest public-spending segment – highway and street – receded 1.0% for the month and is down Public-sector construction spending fell 1.3% in April on a 1.0% slip in highway and street spending and flat educational and transportation spending.

Public-sector construction spending fell 1.3% in April on a 1.0% slip in highway and street spending and flat educational and transportation spending.

Government spending on educational and transportation construction was flat in April, but spending in those segments year to date has grown 5.1% and a whopping 16.0%, respectively.