Spoiler alert: the United States is facing a major transportation funding shortfall. We’re currently spending about $15B a year more from the highway trust fund then we are bringing in in revenue.

What’s more is that only 25% of total infrastructure funding ($54 billion) comes from the federal government. States are bearing the heaviest burden at 40% (spending $84 billion) and localities pick up 35% of the spending total.

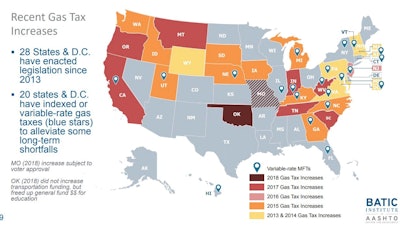

So it’s no surprise that many state legislatures have begun to propose and successfully enact new ways to increase funding in order to reduce their own transportation infrastructure funding shortfalls. Since 2013, 20 states and the District of Columbia have indexed or implemented variable rate motor fuel taxes that will track with the price of fuel, population, vehicle fuel economy, etc. The hope is that this will alleviate some of those long-term downward pressures on fuel tax revenues.

Since 2013, 20 states and the District of Columbia have indexed or implemented variable rate motor fuel taxes that will track with the price of fuel, population, vehicle fuel economy, etc. The hope is that this will alleviate some of those long-term downward pressures on fuel tax revenues.

And states have resources that reach beyond raising the failing motor fuel tax.

“States seem to be moving away from a fixed cent per gallon fuel tax and moving towards something that has a variable rate over time,” Kevin Pula, senior policy specialist at the National Conference of State Legislatures says. “Since 2013, 20 states and the District of Columbia have indexed or implemented variable rate motor fuel taxes that will track with the price of fuel, population, vehicle fuel economy, etc. The hope is that this will alleviate some of those long-term downward pressures on fuel tax revenues.”

Additionally, the Transportation Governance and Finance 50-State Review found that states are using over 50 different funding mechanisms to raise their own money for transportation.

So just how are states succeeding? During a recent AASHTO webinar, three states discussed the infrastructure revenue packages recently approved by their state legislatures and how that money is being put to work.

South Carolina

South Carolina Secretary of Transportation Christy Hall says that communication was key in breaking down the 30-year funding barrier in her state, which has the fourth largest highway system in the nation.

“This landmark legislation that passed in South Carolina essentially doubled the funding for the SCDOT,” Hall says, but the state had to work hard and make compromises to get there.

“In South Carolina, the DOT is often picked on as problematic,” Hall says. “It was absolutely essential to create and establish credibility so that when we described why we didn’t have enough funding to meet the needs that were out there and made presentations on how we were going to utilize new funds, we were believed.”

Instead of proposing a large, unobtainable, fiscal amount needed to improve the roadways, the state created a menu of options to drive the dialogue at the policy level.

“When we shifted from the mindset of ‘here’s what we need’ to ‘here’s what we can deliver’ that was a big breakthrough moment for us,” Hall says. “Instead of saying we need to triple state resources in order to meet the needs of the system, we switched it up and laid out what we would deliver, at different monetary levels, if we had the funding and that made a huge difference for us.”

Those funding measures agreed upon by the legislators will provide more than $600 million annually toward fixing South Carolina’s crumbling roadways and cut taxes by $105 million. To do this, here’s what happened:

- The state’s per-gallon gas tax will increase by 12 cents over six years, to 28.75 cents in 2022. The first 2-cent increment took effect July 1 2017

- The sales tax cap on vehicles rose from $300 to $500, starting July 1 2017

- People moving to South Carolina will pay $250 to newly register their vehicle bought in another state

- Drivers’ biennial vehicle registration fee increased by $16

- Commercial truckers licensed with out-of-state fleets will pay a fee based on the miles they drive annually passing through South Carolina

- Drivers of hybrids and electric vehicles will pay new fees of $60 and $120, respectively, every other year

As a result of funding increase in South Carolina, the state has been able to make upgrades and add safety features to 1,000 miles of rural roadways, they built 465 new bridges, improved 140 miles of interstates and will double their paving program

As a result of funding increase in South Carolina, the state has been able to make upgrades and add safety features to 1,000 miles of rural roadways, they built 465 new bridges, improved 140 miles of interstates and will double their paving program

As a result, the state has been able to make upgrades and add safety features to 1,000 miles of rural roadways, they built 465 new bridges, improved 140 miles of interstates and will double their paving program.

Oregon

Oregon also enacted the largest state funding mechanism in state history with their Keep Oregon Moving House Bill 2017.

Travis Brouwer, assistant director for public affairs at the Oregon Department of Transportation, says there was general consensus during the long gestation process of this bill that everyone wanted to preserve the transportation system, relieve congestion (particularly in the Portland area) and invest more state resources in public transportation.

HB 2017 provided over half a billion dollars in total revenue for the state highway system as well as nearly a $100 million for public transportation funding.

To do this, Oregon increased their gas tax 10 cents in four steps over six years – with the last three increases conditioned on meeting accountability requirements.

“Six cents of that gas tax is conditioned, meaning that ODOT and local governments have to use the money to deliver certain projects and provide certain accountability information to the public or the increases won’t go into effect,” Brouwer says.

The legislature also turned to registration and title fee increases in three steps. There are also surcharges for electric vehicles and hybrids that pay little in gas tax ensure they pay their fair share for roads.

These increase amount to the average driver equates to them paying about .8 cents per mile to get better roads that provide more reliable trips – less than they would pay to repair damaged vehicles if roads deteriorate.

Other funding mechanisms under HB 2017 include:

- 0.1% tax on wages will generate $115 million per year for public transportation and cost less than $1 a week for the average worker

- $15 fee on new adult bicycles that cost $200 or more will generate $1.2 million a year for separated biking and walking paths

- 0.5% dealer privilege tax on new light vehicles dedicated to electric vehicle rebates and multimodal transportation projects

Utah

Currently, Utah is in the middle of a four-year process to determine how to fund and maintain all of their transportation transit systems over the next 40 years.

The first thing they did in 2015, under House Bill 362, was replace the existing gas tax of 24.5 cents per gallon with a 12% tax on the average rack price of a gallon of gas.

“In essence what that did in year one was raise the existing base motor fuel tax from 24.5 cents to 29.4 cents,” Utah Senator Wayne Harper says. “However, we found that wasn’t working the way we intended it to be.”

So in 2017, Utah ran another bill, Senate Bill 276, which accelerated the indexing provisions implemented by HB 362 by redefining the fuel tax rate to 16.5% of $1.78. The bill also imposes an automatic CPI trigger starting on January 1, 2019 even if average rack price doesn’t rise above $1.78.

To continue raising funds, in 2018 Utah implemented Senate Bill 71 which removes certain restrictions on the Department of Transportation's ability to establish a tollway on an existing highway, building previous authority for the Department to toll new lanes, new roadways, and High Occupancy Toll lanes.

“This was specifically designed to reach our wonderful ski resorts,” Harper says. “On certain days, you may have three to four hours waiting to get up to them. We think tolls may be a way to address that.” Utah’s Senate Bill 136 contained nearly 6,000 lines of transportation government amendments and new ways to raise funding.

Utah’s Senate Bill 136 contained nearly 6,000 lines of transportation government amendments and new ways to raise funding.

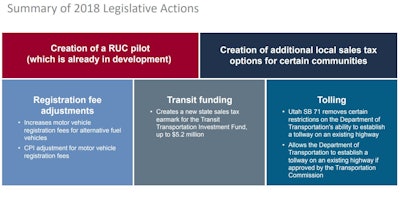

Next, was Utah’s Senate Bill 136 which Harper says was the “hallmark” of the 2018 session. It contained nearly 6,000 lines of transportation government amendments and new ways to raise funding. SB 136:

- Created a Road Use Charge (RUC) pilot that’s already in development

- Created of additional local sales tax options for certain communities

- Imposed a fee in addition to registration fee for electric vehicles, hybrid electric and plug-in hybrids

- Established a new annual fee of $60 growing to $120 by 2021 for electric vehicles, $10 growing to $20 for hybrid electric and $26 growing to $52

- CPI adjustment made for motor vehicle registration fees

- Created a new state sales tax earmark for the Transit Transportation Investment Fund. First year may generate up to $5.2 million. By year 10 on the current projection, it could be up to $40 million raised to address Utah’s transit needs

- The funding allows local jurisdictions to share property tax revenue for transportation capital development projects

As Utah’s population, along with the population of the entire country, continues to grow at a record pace, transportation infrastructure plays a key role in ensuring smooth economic development and these funding measures at a state level are sure to help.

Under the Surface Transportation Block Grant program, states will be seeing $1.98B from the general fund directly allocated to their DOT. There is also a match with this program so states that have not increased their fees will struggle and states that are matching federal dollars will see an even larger increase in their construction market.

This should be seen as a reason for states to increase their highway revenues. States that don’t have the match are leaving good money on the table. That’s a talking point with your legislatures.

You can listen to the full webinar from AASHTO & the BATIC Institute here.