Total U.S. housing starts in September fell by 4.7% -- much steeper than the Total U.S. housing starts in September fell by 4.7% – much steeper than the consensus forecast of -0.4% – to a seasonally adjusted annual rate of 1.127 million. Permits fell 4.5% in September but remain nearly 8% above starts.

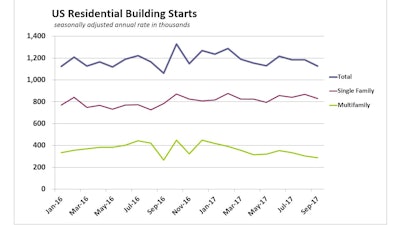

Total U.S. housing starts in September fell by 4.7% – much steeper than the consensus forecast of -0.4% – to a seasonally adjusted annual rate of 1.127 million. Permits fell 4.5% in September but remain nearly 8% above starts.

- The impact of the recent hurricanes

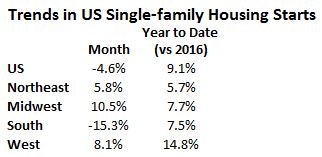

- Continued national trend growth in single-family starts

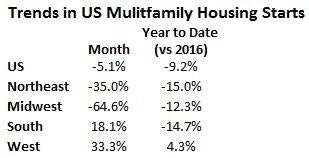

- Continued softening nationwide in multifamily housing production

August starts were revised slightly higher, taking some of the sting out September’s drop.

Permits fell 4.5% in September but remain nearly 8% above starts, setting the stage for a rebound.

September’s drop in starts underscores the importance of Florida and Houston. Total starts also fell in the Midwest and Northeast. The drop was entirely in apartments as single-family starts were up.

Single-family starts plunged 15.3% in the South, but year-to-date the South is

The pace of growth in single-family starts through 2017 compared to the same period in 2016 is consistent with annual growth in 2015 relative to 2014 (10.3%) and in 2016 relative to 2015 (9.4%).

Multifamily starts declined by 5.1% over the month of September to 298,000 units, with steep declines in the Midwest and Northeast. Surprising growth in the South, and a big jump in the West didn’t change the steady decline of multifamily construction year to date.

Year to date, U.S. multifamily starts are 9.2% below their level over the first 9

While repairs on damaged homes are not counted as starts, they may impact starts by worsening labor shortages and driving materials prices higher. Some projects may simply be delayed.