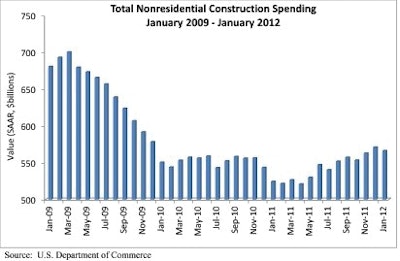

Total nonresidential construction spending decreased 0.8 percent in January to $566.4 billion, according to the March 1 report by the U.S. Commerce Department. However, total nonresidential construction spending was up 7.9 percent from January 2011.

Private nonresidential construction spending was down 1.5 percent for the month but was 16.6 percent higher than one year ago. Public nonresidential construction spending was down 0.1 percent for January but was up 0.4 percent from the same time last year.

Construction subsectors posting the largest monthly decreases in spending included manufacturing, down 6.3 percent; lodging, 3.9 percent lower; and religious-related construction, down 3.5 percent. Subsectors with the largest year-over-year decreases in spending included religious, down 23.1 percent; conservation and development, 17.8 percent lower; and transportation-related construction, down 6.5 percent.

Five of the 16 nonresidential construction subsectors posted spending increases for the month, including water supply, up 9.7 percent; amusement and recreation, 2.1 percent higher; transportation, up 1 percent; health care, up 0.9 percent; and public safety, up 0.3 percent. Eleven of the 16 subsectors posted increases in year-over-year spending, including manufacturing, up 38.3 percent; power, up 24.4 percent; and health care, up 9.7 percent.

Residential construction spending increased 1.6 percent in January and was 5.4 percent higher than the same time last year.

Overall, total construction spending - which includes both nonresidential and residential – slipped 0.1 percent in for the month, but was up 7.1 percent compared to January 2011.

"Today's data release should be viewed as rather disappointing," said Associated Builders and Contractors Chief Economist Anirban Basu. "Because of January's unseasonably warm temperatures across much of the nation, it seemed likely nonresidential construction volumes would increase.

"Instead, nonresidential construction spending dipped nearly one percent in January – adding to a list of data points that have been somewhat disappointing lately," Basu said. "For example, the most recent release regarding durable goods orders also indicated a degree of slowing in business spending.

"However, one month does not indicate a trend," said Basu. "Even in certain categories that experienced construction spending declines in January, like power and manufacturing, year-over-year gains remain meaningful. In addition, December construction spending data was revised substantially higher, rendering the decline in January less worrisome.

"A handful of construction segments experienced monthly spending growth, including transportation, water/sewer and public safety, which may be reflective of stabilizing state and local government capital budgets," Basu said. "The amusement and recreation category also experienced increases in spending in January, perhaps because the U.S. consumer has been demonstrating a renewed willingness to spend on discretionary items.

"Many economists expect that the U.S. economy will continue to expand moderately during the months ahead, which should generally be associated with modest gains in construction spending," said Basu. "However, if business spending continues to slow, stakeholders can expect construction spending to be roughly flat in the coming months."

View the previous spending report.