Caterpillar Inc. (NYSE: CAT) today announced first-quarter 2015 profit per share of $1.81, an increase from profit per share of $1.44 in the first quarter of 2014. The first quarter of 2015 included a negative impact of $0.05 per share for restructuring costs, compared with $0.17 per share in the first quarter of 2014. Excluding restructuring costs, profit per share was $1.86 in the first quarter of 2015, up from $1.61 per share in the first quarter of 2014.

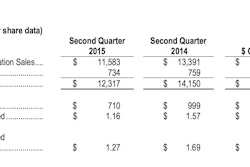

First-quarter sales and revenues were $12.702 billion, down about 4% from first-quarter 2014 sales and revenues of $13.241 billion. First-quarter 2015 profit included a pre-tax gain of $120 million, or about $0.14 per share, from the sale of Caterpillar’s remaining interest in the company’s former third-party logistics business. Caterpillar sold a majority interest in the business in 2012, and divested the remaining interest in the first quarter of 2015.

“We delivered solid results for the first quarter of this year, including higher profit than in the first quarter of 2014. Our focus on operational improvement, including lean manufacturing and cost management, is helping in what is a tough time for some of our important cyclical businesses. We continue to execute on improving safety, quality, inventory turns, delivery performance and market position,” said Caterpillar Chairman and Chief Executive Officer Doug Oberhelman.

“The first quarter wasn’t without challenges. Sales and revenues were off about 4% percent from the first quarter of last year, mining remained weak and construction was down in most regions. On the plus side, Energy & Transportation turned in another great quarter, although we don’t expect this to continue due to the oil-related portion of the business,” added Oberhelman.

Construction Sector

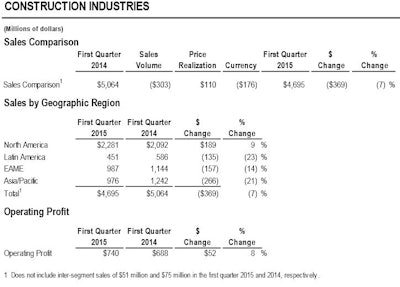

Construction Industries’ sales were $4.695 billion in the first quarter of 2015, a decrease of $369 million, or 7%, from the first quarter of 2014. The decrease in sales was due to lower volume in all regions except North America and the unfavorable impact of currency, primarily from the euro and the Japanese yen, partially offset by improved price realization. Sales of new equipment decreased, and sales of aftermarket parts were about flat.

In Asia/Pacific, the sales decline was primarily due to lower sales in China and Japan. In China, the lower sales primarily resulted from continued weak construction activity. Sales in Japan declined due to a weaker Japanese yen, as sales in yen translated into fewer U.S. dollars and lower end-user demand due to weaker economic conditions.

Sales declined in EAME primarily due to the unfavorable impact of changes in dealer inventories, as dealers increased inventory more during the first quarter of 2014 than in the first quarter of 2015. In addition, the impact of currency was unfavorable as sales in euros translated into fewer U.S. dollars.

Decreases in Latin America were primarily related to the absence of a large government order in Brazil that occurred during the first quarter of 2014 and continued weak construction activity.

Sales increased in North America primarily due to the favorable impact of changes in dealer inventories, as dealers increased inventory more during the first quarter of 2015 than in the first quarter of 2014. In addition, price realization was favorable and end-user demand increased modestly.

Although still below prior peaks, construction-related activity continues to improve. Construction Industries’ profit was $740 million in the first quarter of 2015, compared with $688 million in the first quarter of 2014. The improvement was mostly due to the favorable impacts of price realization and currency, primarily from the Japanese yen, partially offset by lower volume.

2015 Outlook

Overall, Caterpillar's view of world economic growth in 2015 is about the same as expected in the outlook provided with the 2014 year-end financial release in January of 2015. It expects world GDP growth in 2015 of about 2.7%, up from about 2.6% in 2014.

‘Facing a Tough 2015,’ Caterpillar Sets Sales Outlook 9.4% Below 2014

The company expects that the improvement will come from developed countries and that economies in developing countries will, overall, grow at a rate slightly below their growth rate in 2014. Despite the outlook for modest improvement in global economic growth vs. 2014, significant risks and uncertainties remain that could temper growth in 2015, as political conflicts and social unrest continue to disrupt economic activity in several global regions.

The outlook for sales and revenues remains unchanged at about $50 billion for 2015, down from $55.2 billion in 2014. The primary factors contributing to the decline from 2014 are largely the same as expected three months ago:

- Lower oil prices are expected to negatively impact sales of reciprocating engines within Energy & Transportation and Construction Industries’ sales in oil-producing countries around the world, including regions of the United States that rely on oil revenues to drive economic growth;

- The currency translation impact of a stronger U.S. dollar on sales outside the United States;

- Weaker mining sales;

- Lower sales in the rail business, primarily for locomotives; and

- Lower sales in China, primarily for construction equipment.

While the outlook for sales and revenues is unchanged, the expectation for profit has improved. Caterpillar now expects that 2015 profit per share will be $4.70, or $5.00 per share excluding restructuring costs. The previous outlook for 2015 profit per share was $4.60, or $4.75 excluding restructuring costs. Profit per share in 2014 was $5.88, or $6.38 excluding restructuring costs.

Click here to download the full version of the Caterpillar Inc. 1Q 2015 results.