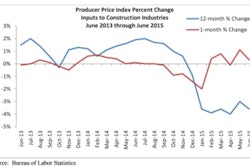

Prices for inputs to construction industries expanded by 1.1 percent in May, the largest month-over-month increase in more than two years and only the third time in the past 10 months that construction input prices have grown on a monthly basis. Year-over-year prices fell by 3 percent in May and have now fallen by more than 3 percent in each of the year's first five months. The last time this occurred was the third and fourth quarter of 2009. Only three of the 11 key construction inputs—nonferrous wire and cable, crude petroleum and crude energy materials—experienced monthly price increases in May.

"Commodity markets experienced a reversal of several patterns that have been in place for many months in May," said Associated Builders and Contractors' Chief Economist Anirban Basu. "Most notably, key energy prices rose meaningfully, with oil prices rising to roughly $50 per barrel. While natural gas prices did not rise for the month according to the producer price index, they remained relatively flat after falling by more than 10 percent in three of the year's first four months. Many economic forces were at work, including a weaker U.S. dollar. Many commodities are priced in dollars, which helps to lay a floor under the associated prices. With the European economy showing signs of life the dollar's rise against the euro has effectively stalled.

"Stakeholders should not consider this the beginning of a new trend," said Basu. "There are a number of reasons to expect the U.S. dollar to advance against other major currencies during the next few months, including an anticipated shift in monetary policy. Last year, the U.S. Federal Reserve ended its quantitative easing program, and interest rate increases are likely during the month ahead. This will help suppress further increases in commodity prices, including those related to energy. Key elements of the global economy also continue to stumble, including in China, with its worst world outlook in approximately 20 years, and in Brazil, which is not expected to expand economically in 2015."

Only three of the key materials' prices increased in May.

- Crude petroleum prices expanded 15.6 percent in May but are down 42 percent from the same time last year.

- Crude energy materials prices gained 7.7 percent in May but are 37.3 percent lower year-over-year.

- Nonferrous wire and cable prices expanded 0.9 percent on a monthly basis but shed 2.8 percent on a yearly basis.

Eight of the 11 key construction inputs did not expand for the month.

- Fabricated structural metal product prices dropped 0.5 percent lower for the month but have expanded 0.8 percent on a year-over-year basis.

- Natural gas prices fell 1.7 percent in May and are down 48.4 percent from the same time one year ago.

- Prices for plumbing fixtures remained flat in May and are up 4.9 percent on a year-over-year basis.

- Prices for prepared asphalt, tar roofing and siding fell 1.5 percent for the month and are down 1.9 percent on a year-ago basis.

- Iron and steel prices fell 1 percent in May and are down 14.9 percent from the same time last year.

- Steel mill products prices fell 2 percent for the month and are 11 percent lower than one year ago.

- Softwood lumber prices fell 2.5 percent and are 7.9 percent lower than one year ago.

- Concrete product prices grew 1.3 remained flat in May and are up 4.9 percent on a yearly basis.

View the April PPI report.