The drive toward zero emissions is a complex undertaking for the heavy-duty truck and large earthmoving machine markets. It will require innovative product solutions backed by a stable infrastructure that is cost comparative to running existing diesel-powered machines.

During an April 29, 2021, press conference on driving a hydrogen future, Martin Daum, CEO, Daimler Truck, and Martin Lundstedt, CEO, Volvo Group, shared their visions of the future. “The road to zero emissions is like a multiplication problem,” Daum stated. “We need an attractive vehicle offering, we need a working infrastructure and we need cost parity. Those three factors are combined like multiplication. You know from high school in multiplication if one factor is zero, it doesn’t matter how big or how large the other factors are, the product is always zero.” All three factors need to be present in order for the solution to work.

Meeting regulatory requirements and fleet goals to de-carbonize large construction equipment and heavy Class 7 and 8 trucks is going to require customized solutions. While there has been a lot of progress on battery electric vehicle (BEV) technology in compact construction machinery and light automotive applications, the power densities required by large earthmoving machinery and Class 7 and 8 trucks coupled with long work shifts may favor other solutions.

If the goal is to simply reduce greenhouse gas emissions, renewable fuels can provide a cost-effective option. According to Alastair Hayfield, Interact Analysis, carbon neutral fuels such as biodiesel are a good choice because they’re achievable and don’t require a big investment. “They are definitely an option because, practically, it is going to be very difficult to electrify everything. There are certain applications where it makes no sense from a cost perspective or an operational perspective,” he points out.

Hydrogen Debate Resurfaces

Lately, hydrogen has re-entered the discussion as a promising solution for heavy earthmoving and other applications that require extreme power densities over long periods of time.

In July 2020, JCB announced it had developed a hydrogen-powered excavator. The 20-tonne 220X excavator prototype is powered by a hydrogen fuel cell and has been undergoing testing at the company’s quarry proving grounds. “JCB will continue to develop and refine this technology with advanced testing of our prototype machine, and we will continue to be at the forefront of technologies designed to build a zero-carbon future,” says Lord Bamford, JCB Chairman.

In March 2021, SANY shared that two hydrogen fuel cell-powered vehicles had rolled off its production line: a dump truck and a mixer truck. The company asserts that heat and water vapor are the only emissions from these hydrogen-powered vehicles. In addition, SANY says these new vehicles provide increased power due to the high-power fuel cell stacks utilized in conjunction with a large torque drive motor and AMT gearbox. Longer driving distances are possible, as well, using hydrogen cylinders with a combined capacity of 443.8 gal.(1,680 L), which ensures a driving range of over 310.7 mi. (500 km).

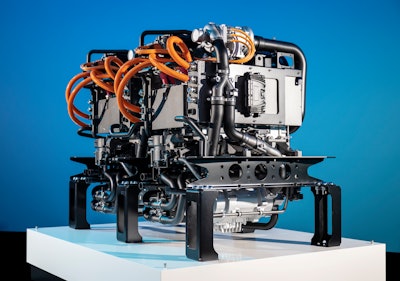

Cellcentric is working intensively to prepare series production of fuel cells.Daimler Trucks

Cellcentric is working intensively to prepare series production of fuel cells.Daimler TrucksHyundai Construction Equipment recently decided to join forces with Hyundai Motor Group to develop hydrogen-powered construction machinery. Hyundai Motors and Hyundai Mobis will design and manufacture hydrogen fuel cell systems, including power packs, while Hyundai Construction Equipment will design, manufacture and evaluate the performance of excavators and forklifts. The target date for mass production and distribution has been set to 2023.

Unlike conventional diesel engine-based equipment, hydrogen fuel cell-based electric construction equipment uses electricity produced through the chemical reactions between hydrogen and oxygen as its power source, meaning no emission of toxic gases into the air. Given the rapidly rising demand for eco-friendly equipment around the world in recent years, hydrogen-based construction equipment is expected to help Hyundai Construction Equipment compete in the global construction market moving forward.

Furthermore, compared to lithium batteries, which have been marred by structural issues limiting various attempts to increase battery capacity, hydrogen fuel cells are much easier to expand, making them a much more logical choice for large forklifts or excavators.

There are many different solutions for electrifying fleets, depending on machine size and application. “Hydrogen is an important part of the whole equation,” says Volvo Group’s Lundstedt. “It is a very important answer as energy storage where we cannot rely on electric generation where it happens in a green form, but also to be able to store it and complement the battery electric execution.”

Fuel cells are just a different way to power an electric vehicle vs. a battery. “Both of them will play a very important role, where fuel cell electric vehicles have clear advantages in certain areas and battery electric vehicles have clear advantages in other areas,” says Lundstedt.

Is There Life Left in Internal Combustion?

There are two ways hydrogen can be utilized as a fuel source. It can be burned in a conventional internal combustion engine or it can be used to produce electricity through a fuel cell. The attraction of burning hydrogen is that it utilizes much of the existing diesel engine technology infrastructure. It simply requires that the internal combustion engine be modified to burn hydrogen instead of diesel.

Since the infrastructure for the internal combustion engine already exists, alternate fuels that use this technology can reduce initial investment. “It’s expensive to get an electrified product offering,” notes Hayfield.

“Just recently there have been a number of manufacturers reviving this concept of hydrogen internal combustion engines,” he continues. “It is not something new. It’s been around for a number of years. But it is getting a little traction now because certain applications within off-highway, in particular, are very difficult to decarbonize. Clearly, there will be pressure to do that somehow.

JCB is testing its hydrogen powered 20-tonne excavator at its quarry proving grounds.JCB

JCB is testing its hydrogen powered 20-tonne excavator at its quarry proving grounds.JCB“Battery electric is not going to be suitable for a large excavator. You have to decarbonize, so what do you do? Obviously, a fuel cell is one option. Biofuels or carbon neutral synthetic diesel is another. A hydrogen internal combustion engine is another alternative,” Hayfield states.

Fuel storage design on the machines is one of the biggest challenges if the machine is going to burn hydrogen. “You have to add compressed storage tanks to the vehicle and that adds quite a bit of cost which you obviously wouldn’t have with a diesel-powered engine,” says Hayfield.

While burning hydrogen does eliminate carbon emissions, there are still emissions produced. “Primarily it’s water and nitrous oxide. From a greenhouse gas perspective, it is great,” says Hayfield. “Because of the high temperature, you do get nitrous oxides produced. Those are the particulate matters that cause respiratory problems for people. Those can be minimized. You can’t get rid of it completely. If legislators choose to focus on that as something that is going to be banned, that’s a problem.”

The cost/benefit ratio of burning hydrogen also remains a question. “It’s going to continue to be expensive to produce hydrogen, particularly if it is green hydrogen,” Hayfield comments. “I am not sure the best use is to burn it. The efficiency of a fuel cell is much higher so it would make more sense to use a fuel cell.”

The Transition to Fuel Cells

Many companies have built prototypes that utilize hydrogen fuel cell technology. “The hydrogen fuel cell is gaining quite a bit of traction in very heavy applications,” says Hayfield. “I would expect to see fuel cells being quite an important part of the product mix for that area.”

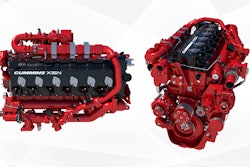

The hydrogen fuel cell solution has the advantage in that it can be a true zero-emissions technology, depending upon how the hydrogen is produced. “We see hydrogen fuel cells and battery electric power as complimentary technologies in a portfolio of zero-emission powertrains,” says Jeremy Harsin, off-highway business director, Cummins Ltd. “There is no one-size-fits-all universal solution. Hydrogen makes sense for larger equipment with high utilization and energy demands due to the charging infrastructure limitations and the size of batteries needed.”

For heavier duty cycles, fuel cells offer more flexibility and higher machine utilization.Cummins

For heavier duty cycles, fuel cells offer more flexibility and higher machine utilization.CumminsBattery charge times are a consideration when it comes to larger equipment. “The long recharging times required by larger equipment can be a deterrent,” says Harsin. “For heavier duty cycles, fuel cells would offer more flexibility and higher machine utilization. Battery electric power is more suited to compact, lighter duty machines, particularly in the rental sector.”

Large machines need to carry enough energy to complete their mission. “Onboard storage is a critical component of hydrogen power to store enough to meet duty cycle requirements of a machine,” says Harsin. “Cummins is investing in storage technology with joint venture NPROXX, a world leader in high-pressure hydrogen storage for stationary and mobile applications.”

The performance of the hydrogen fuel cell vs. the conventional diesel engine it replaces will be determined by the efficiency of the system design. “The interaction between fuel cells, batteries, powertrain and fuel storage will determine this,” says Harsin.

He adds, “Understanding and adapting the overall powertrain system will be crucial going forward. The battery size and fuel cell depend on the duty cycle of the machine. The integration effort is very important to specify the right solution. This encompasses every component that converts the power source into movement and is an area where Cummins has deep experience and understanding.”

Fuel Cell Development

Europe is leading the charge when it comes to driving a hydrogen economy, with European policymakers, the scientific community and manufacturers committing significant resources. The Volvo Group and Daimler Truck formed a 50:50 joint venture, cellcentric, to become a global manufacturer of fuel cells. cellcentric has been tasked with the development, production and commercialization of fuel cells in heavy-duty trucks and other areas. The joint venture has been up and running since March 2021.

“We have been talking about hydrogen and the potential of hydrogen for quite some time,” says Lundstedt. “I have been in this industry 30 years and we have always said it is about 10 years away. But now we are really getting here. We see a clear roadmap for execution both when it comes to technology and commercialization. It’s very promising.”

Electrification is the way forward. “To put it into perspective, we are talking a lot about electric vehicles — batteries, fuel cells, etc.,” says Lundstedt. “It’s important to put into context that all of those are electric vehicles, with the outcome of electric vehicles that we want to achieve with fossil-free executions, with much lower noise, with reduction of NOx and particulate matter.”

Battery electric technology is better suited for shorter distances and lower payloads. “There is an overlap obviously, but when we talk about longer distances and more heavyweight applications, fuel cell electric vehicles will be very well suited, and in particular for demanding long haul applications with a high level of flexibility, long range, forced refueling and high payload,” Lundstedt states.

That’s why Volvo Group joined forces with Daimler Truck to create cellcentric. “It will build upon the strengths, to scale faster, to show a clear direction moving forward and make sure we are investing here and now to hand over a planet for coming generations,” says Lundstedt. “Fuel cells and cellcentric will play a key role and we are excited to have this opportunity.”

cellcentric is focused on heavy truck and other heavy commercial applications to produce the power output, durability and modularity the industry demands. “We are reducing the cost step by step in a very concrete roadmap,” says Lundstedt.

There are several advantages to hydrogen fuel cells, which Daum outlined during the April 2021 presentation: “Trucks are often used very flexibly. There are non-predictable routes, surprise transportation tasks where you can’t plan ahead and you need an energy source that gives you reach and dependability and, if you need, immediate recharge like what we have today with diesel.” Hydrogen provides this flexibility.

Then there are infrastructure considerations. “It’s always easy for the first 1,000 trucks to run on electric and use an electric power grid, but we are looking to a future where 100,000s, if not millions, of trucks need the electric power grid at the same time when 10 million or more cars also need the same power grid,” Daum pointed out. “So, in this sense, we need a second source for energy. That energy is hydrogen. Hydrogen has one big advantage — it scales nicely. The more people that use it, the cheaper it gets.”

Clean Hydrogen Needed

Hydrogen is currently not necessarily a clean power source. It really depends on how it is produced.

“One of the biggest challenges that you have is that most of the hydrogen produced today is called brown hydrogen,” says Hayfield. “It is made from the by-products of the petroleum industry, so it’s not clean. There are carbon emissions associated with it.” So, you are not really decarbonizing if you utilize it as a fuel source. “You are just moving the problem somewhere else down the supply chain.”

Cummins is focusing its hydrogen development efforts in three areas, including electrolyzer technology for the production of hydrogen.Cummins

Cummins is focusing its hydrogen development efforts in three areas, including electrolyzer technology for the production of hydrogen.CumminsBut hydrogen does have potential. “To provide a truly zero-emissions solution, hydrogen production needs to be green, i.e., produced without direct emissions of air pollutants or greenhouse gases,” says Harsin. “Without being green, it cannot be a meaningful part of the solution for a zero-emissions future.”

He adds, “Cummins is involved in Electrolyzer production, which is used to generate green hydrogen with renewable energy. A recent project is producing up to 8.2 tons per day of low-carbon hydrogen in Bécancour, Québec.”

You need to start somewhere. “There are more realistic plans now to move to things like blue hydrogen or green hydrogen,” says Hayfield. “That potentially brings around the ability to use this as a fuel and it doesn’t have any carbon emissions. It’s much more sustainable. One of the key things here is going to be that ramp up of blue hydrogen or green hydrogen and we’re still a number of years away from that.”

You need to look at the entire energy chain. “The hydrogen that we sell needs to be green hydrogen as any energy going into a battery electric vehicle needs to be green energy. Otherwise, burning diesel would still be better for the environment than burning coal someplace and then feeding that either as electricity or hydrogen into a vehicle,” says Daum.

“Clearly, using hydrogen has potential, but it is only going to fulfill its biggest potential if it can all be green hydrogen, and we’re a long way off of doing that now,” says Hayfield. “You have to start somewhere, but you cannot fix everything at once.”

Infrastructure Challenges

Like most alternative energy solutions, hydrogen also faces an infrastructure challenge. Hydrogen generation, storage and infrastructure are some of the key challenges facing the market.

“Even with many projects in place to increase hydrogen refueling, that will take time and resources to develop,” says Harsin. “Adoption of hydrogen will likely begin in markets where fueling can be done centrally, such as at home base operations or close to large hydrogen hubs where there is access to affordable renewable power.”

The hydrogen infrastructure is the key challenge holding back mass adoption. During Daum’s presentation last April, he explained, “If we would have a working infrastructure, it would be extremely easy to sell 100,000 fuel cell trucks and we would have 100,000 fuel cell trucks on the road. Unfortunately, we will never have 100,000 trucks out on the road without infrastructure.” This will require support from energy companies and politicians to secure the initial investment.

Component cost will continue to be an important factor, as well. “We just did a piece of research looking specifically at pricing for electrified components for off-highway applications,” says Hayfield. “One of the biggest challenges is low volumes. You cannot get the same pricing for batteries that GM or Tesla does. If you go to the manufacturer and say you need 1,000, the price ends up being three or four times what it is in automotive. That’s another challenge this industry has to face. It is another thing that is going to make electrification or decarbonization very difficult in this space. How many engineering dollars do you want to invest if you are selling a couple thousand units a year?”

In other words, don’t expect an overnight switch to hydrogen fuel cell technology. “The adoption of fuel cells will be gradual over the next five to 10 years as they become not just environmentally but operationally and economically viable for OEMs and operators,” predicts Harsin.