According to the Associated General Contractors of America (AGC) analysis of the most recent U.S. Bureau of Labor Statistics data, nonresidential construction input prices for materials and services increased 1.1% between May 2022 and June 2022. In total, prices have increased 16.8% since June 2021.

Changes in material prices include:

- Asphalt and tar roofing and siding products (+ 3.2% from May 2022 to June 2022; +22.2% since June 2021)

- Concrete products (+1.7%; +13.5%)

- Diesel fuel (+14.1%; +111.1 %)

- Plastic construction products (+1.5%; +27.0%)

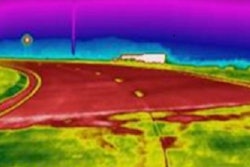

- Paving mixtures and blocks (+2.9%; +17.7%)

Contractor bids, the AGC said, are not able to keep pace with increases. And it appears that material prices will continue their upward march.

During a July 14 Roundtable entitled “Inflation Crisis Impacts on Infrastructure" held by the Republicans on the Transportation and Infrastructure Committee, the witnesses who testified agreed with this sentiment.

Representative Sam Graves (R-MO), who chaired the Roundtable said: “it’s possible and even likely that the bad economic news is going to get worse,” and that “(t)he Biden administration has left inflation completely unchecked.”

Impact of Inflation on IIJA Project Delivery

While State DOTs are accustomed to doing more work with less money, the stress they are feeling due to price increases and the supply chain are forcing companies to lose business. What's more, the dollars from the Infrastructure Investment and Jobs Act (IIJA) are not even coming close to making an impact due to inflation.

“Inflation is hitting the pocketbook of every American, and it’s hitting the transportation and construction industries particularly hard,” Graves said. “As a result, inflation is eroding the value of the infrastructure law’s funding and causing states to delay or cancel projects."

The challenges contractors face as inflation remains at historic levels, as infrastructure dollars decline in value and as projects become more and more difficult to carry out, are far reaching.

George Palko, president of Great Lakes Construction Company and current AGC Highway Transportation Division Chairman, told the panel that in recent months inflation-related cost overruns led to his firm having three bids rejected by Ohio DOT.

"Being a contractor, we are experiencing construction inflation and the impacts of not getting jobs awarded," Palko said. "We are seeing vendors and subcontractors walking away because of what costs really are by the time a job gets awarded."

One of the jobs Great Lakes bid on was a project in Cincinnati that they estimated would cost $270 million. The Ohio DOT had estimated it at $180 million, making it clear that project estimates are not keeping up with inflation.

"Those estimated numbers constitute the states budgets for the year for their transportation programs," Palko said. "If we are going to continue to exceed budgets and estimates by 15, 20 even 50 percent, how are we going to show the public that we are putting additional work into place? That's a major concern of ours."

How Will Bids Compete?

With prices rising, contractors are facing extreme challenges in bidding out work for the longterm projects the IIJA calls for and the problem is twofold. Projects that are happening right now are experiencing financial hardships due to the supply chain and projects that have three to four year timelines are being bid with prices as they stand today - making them much more expensive.

"Prior contracts, in terms of contractors, are not being impacted by construction inflation if they were sold prior to six months ago," Palko said. "It's the supply chain that is dictating more of a problem on prior contracts. For projects that have been sold within the last six months through today, the problem is definitely construction inflation. With vendors and subcontractors changing terms from quoting us a firm price at the time of delivery, to quoting us a price at the time of bidding to time of actual delivery. So if we aren't going to put in a steel pipe in place until two years from now, we are guessing what the price will be and building it into our price that we submit to the DOT."

And the demand to lock prices and contracts in place is extreme.

"There is a pressure to commit to a job sooner rather than later especially as there is a 40-50% price increase on the top items we use on these projects," Dr. Shawn Wilson, secretary of the Louisiana Department of Transportation said. "If there is a multi-year project, you will see instability in pricing and in material availability. The answer isn't necessarily to pay more, but maybe to extend the time or to allow alternative materials to get through this."

Right now, suppliers are also only guaranteeing prices for shorter windows of time.

"We need to get projects moving faster because of this," Wilson says. "We need to give reassurance and give advance notification for contractors to be able to proceed with these commitments."

Witnesses of the Roundtable included representatives from the National Stone Sand and Gravel Association, American Trucking Associations, Associated General Contractors of America, National Association of Manufacturers, American Association of State Highway and Transportation Officials, Virginia Department of Emergency Management and City of Wilmington, NC.

The Roundtable witnesses and the AGC have called on public officials to take measures to curb rising prices, particularly since they are impacting the affordability of public infrastructure projects. Government agencies, the AGC said, should address supply chain issues, and the Biden administration should remove construction material tariffs that are contributing to rising prices."

"The more materials prices increase, the harder it will be for public officials to build new schools, roads and other infrastructure," said Stephen Sandherr, the AGC's CEO. "Taking steps to address rising materials prices will help construction employers and taxpayers alike."