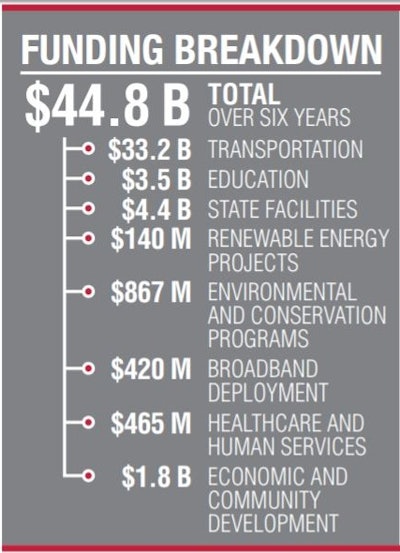

Governor JB Pritzker signed into law the $45 billion Rebuild Illinois plan, the most robust capital improvement program in Illinois history and the first in nearly a decade.

The historic plan was passed by bipartisan supermajorities and will invest $45 billion in roads, bridges, railways, universities, broadband internet access, early childhood centers and state facilities like the crime lab and veterans' homes over the next six years. The office of the governor says the projects will create an estimated 540,000 jobs over the life of the plan.

The Rebuild Illinois package consists of four bills: HB 62, appropriations for capital projects; SB 1939, revenue for horizontal construction; HB 142, bond authorization; SB 690, gaming expansion, including revenue for vertical construction.

House Bill 62

Rebuild Illinois makes critical investments in infrastructure across the following areas, many of which will be subject to a rigorous process for determining projects and providing grants:

Transportation: $33.2 billion

More than $14 billion for new roads in bridges:

Nearly $11 billion for IDOT's Multi-Year Plan for roads and bridges

$4.7 billion for mass transit, including the RTA (CTA, Metra and Pace)

$1 billion for passenger rail, including Amtrak and other inter-city rail projects

$558 million for aeronautics

$492 million for the Chicago Region Environmental and Transportation Efficiency Program (CREATE)

$312 million for grade crossing protection

$150 million for ports

$679 million for other transportation projects

Education: $3.5 billion

$2.9 billion for higher education

$415 million for preK-12 school maintenance

$111 million for early childhood education

State Facilities: $4.4 billion

$4 billion for deferred maintenance and new projects at state facilities

$350 million for the State Capitol

Environment/Conservation: $1 billion

$867 million for environmental, conservation and recreation projects, including:

- $290 million for hazardous waste

- $110 million for water revolving fund

- $100 million for unsewered communities

- $92 million for ecosystem restoration

- $75 million for park and recreational facility construction

- $40 million for well plugging

- $35 million for land acquisition

- $31 million for flood mitigation

- $29 million for Illinois green infrastructure grants

- $23 million for Open Space Land Acquisition and Development

- $22 million for dam and waterway projects

- $20 million for conservation reserve enhancement

$140 million for renewable energy projects, including solar and energy efficiency upgrades at state facilities and transportation electrification in low-income communities

Broadband Deployment: $420 million

$400 million for statewide broadband expansion

$20 million for Illinois Century Network

Healthcare and Human Services: $465 million

$200 million for affordable housing

$200 million for hospital and healthcare transformation

$50 million for community health centers

$15 million for human services grant program

Economic and Community Development: $1.8 billion

$594 million for community development

$425 million for economic development

$401 million for public infrastructure

$112 million for education and scientific facilities

$75 million for economically depressed areas

$51 million for museums

$50 million for libraries

$50 million for emerging technology enterprises

$50 million for the arts

$25 million for an apprenticeship program

$15 million for Minority Owned Business Program

Senate Bill 1939

SB 1939 provides revenues to fund the horizontal projects in the Rebuild Illinois capital plan. It increases the motor fuel tax, which is sent to lockbox that exclusively funds critical transportation projects across the state:

- Raises the motor fuel tax per gallon from 19 cents to 38 cents on July 1, 2019 and indexes it to the Consumer Price Index. If the motor fuel tax had been indexed to inflation the last time it was raised, it would be 38 cents - another indication of Illinois' long failure to invest in needed maintenance of roads and bridges.

- Increases the special fuels tax (on diesel fuel, liquefied natural gas, or propane) by 5 cents per gallon. The current tax is 2.5 cents per gallon, in addition to the regular motor fuel tax. This increase will generate $78 million in new annual state revenue, which is dedicated to the Road Fund.

- Creates the Transportation Renewal Fund to receive the increased motor fuel taxes.

- Revenue realized from the 19-cent increase in the motor fuel tax in SB1939 will be split between three purposes: 48% will go to the State Construction Account Fund for use on state roads and bridges, 32% will go to units of local government through the motor fuel tax formula, and 20% will go to local transit districts.

- Allows Cook County municipalities to impose an additional 3 cent local motor fuel tax.

- Allows Lake and Will counties the same authority as DuPage, Kane and McHenry counties to impose a county motor fuel tax to be between 4 cents and 8 cents and indexes it to CPI.

This increase will result in an additional $400 million per year to local governments (municipalities and local road districts) for local roads and bridges, $250 million to transit districts, and $590 million to the state in FY20.

Title fees: Increases the title registration fee from $95 to $150 for regular title fees and $95 to $250 for mobile homes. Decreases the duplicate title fee from $95 to $50. Increases the salvage certificate fee from $4 to $20. Creates a new title fee for junk vehicles at $10. These increases are effective July 1, 2019 and will generate $146 million in new annual state revenue.

Vehicle registration fees: Increases the annual vehicle registration fee from $101 to $151 beginning with 2021 registrations and the electric vehicle registration fee from $34 every other year to match the registration fee for regular vehicles, plus $100 per year in lieu of motor fuel tax payment, effective January 1, 2020. Increases truck registration fees by $50 for vehicles 8,000 pounds and under and $100 for vehicles 8,001 pounds and over. Combined, these increases will result in $529 million in new annual state revenue.

Commercial distribution fee: Repeals the commercial distribution fee on July 1, 2020.

Sales tax shift: Beginning in FY22, one-fifth of the net 5% state sales tax on motor fuel purchases will shift per year from deposit into the General Funds to the Road Fund, with the full amount deposited into the Road Fund by FY26. This will result in $600 million annually at full implementation (shift of revenue only, not an increase).

Pedestrian and bicycle facilities: Sets aside $50 million in funding for pedestrian and bicycle facilities and the conversion of abandoned railroad corridors to trails.

Transportation Funding Protection Act: Creates this act, which requires local governments to use transportation revenues and fees for transportation purposes only.

House Bill 142

HB 142 provides $22.6 billion in additional bonding authority, which will allow the state to fund much needed improvements in infrastructure in every region of the state. HB 142 increases that authority to $60.8 billion.

HB 142 creates the Multi-modal Transportation Bond Fund, Transportation Renewal Fund, Regional Transportation Authority Capital Improvement Fund, Downstate Mass Transportation Capital Improvement Fund, and Rebuild Illinois Projects Fund.