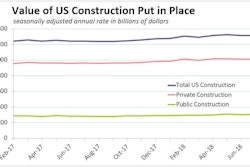

FMI, in its third-quarter 2018 construction outlook, forecast total engineering and construction spending for the U.S. to grow 6% for the year, compared to up 5% in 2017.

Spending growth in 2018 is forecast to be led by select nonresidential and residential segments. Current top-three-performing segments forecast through year-end 2018 include transportation (+13%), public safety (+10%) and conservation and development (+10%). Based on year-to-date spending as of July, these segments represent 6.7% of the value of all construction put in place.

The bottom three- performing segments include religious (-4%), power (+2%) and manufacturing (+2%). Based on year-to-date spending as of July, these segments represent 15.2% of the value of all construction put in place.

The lodging and water supply segments appear to be strengthening into the third quarter, and FMI has upgraded them from ‘Stable’ to ‘Up’ through 2018 (+8% and +7%, respectively). Additionally, spending in the huge power segment has increased in recent months, and FMI promoted the segment from ‘Down’ into ‘Stable’ territory at 2% growth through 2018.

Two segments that were downgraded this quarter are educational and religious. Educational spending has been shifted downward to ‘Stable’ at only 3% growth. Religious spending has been downgraded from ‘Stable’ to ‘Down,’ with an expected 4% decline through the year-end.

See the FMI U.S. Construction Outlook – Third Quarter 2018 Report (free)