Recent data points in M Science’s work suggest the equipment rental market is experiencing a healthy and accelerating recovery, characterized by improving fleet utilization, moderating rental rate declines, a favorable capex environment, and wide-spread increases in hiring. Our data generally supports a more optimistic outlook and faster recovery than operators had forecasted several month ago, presenting an encouraging read-through for 2021.

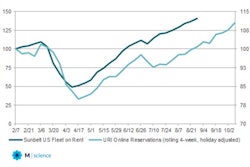

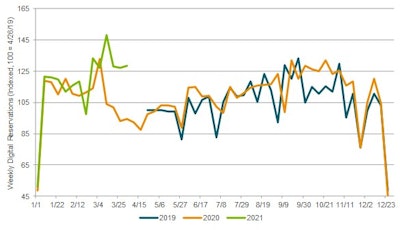

Digital Reservation Volumes Suggest Higher Fleet Utilization in Early 2021

At M Science, we track online reservation volumes at United Rentals and Sunbelt as a barometer for underlying fleet on rent. Please note, due to the growing share of online orders over time, trends in our online reservations data typically outpace underlying volume growth on a Y/Y basis.

Digital Reservations in Q1’21 signal a marked improvement in underlying activity levels with our data for both United Rentals and Sunbelt tracking well ahead of Q4’20, and accelerating through the course of the quarter with March volumes finishing up double-digits Y/Y at both operators. At United Rentals, digital reservations in our work increased 10 percent Y/Y in Q1’21 and 26 percent Y/Y in March, ahead of 6 percent Y/Y growth in Q4’20. March volumes were very encouraging and likely reflecting both improving underlying demand and a rebound from a slower February, which was impacted by weather-related delays. We expect growth rates are likely to accelerate further in Q2’21, lapping COVID-19 related headwinds.

Hiring Activity Picking up Across Public Rental Houses

Job Listings Across North American Rental HousesM Science

Job Listings Across North American Rental HousesM Science

In the context of moderating rental rate pressure, improving fleet on rent trends, and reduced used equipment for-sale inventory, we view the pickup in hiring as an encouraging read into growing project backlogs and greater confidence in human capital needs in the coming months.

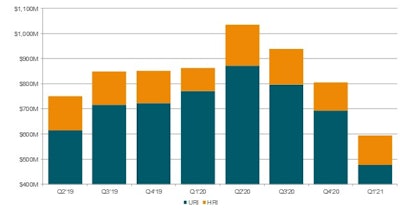

Used Equipment Listed for Sale Reaches a Two-Year Low, Providing Encouraging Capex Outlook

United Rentals and Herc Rentals Used Equipment Listed for SaleM Science

United Rentals and Herc Rentals Used Equipment Listed for SaleM Science

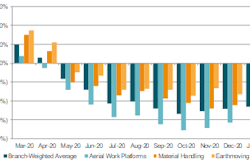

Rental Rate Declines Moderate in Q1, Likely to More Notably Improve in Q2

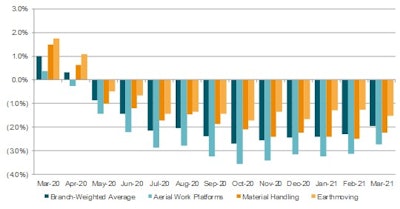

At M Science, we track general rental rates for +600 equipment SKUs at +1,000 United Rentals’, Sunbelt Rentals’, and Herc Rentals’ branch locations to understand how rental rates are changing at the largest market participants (~23 percent of the market) on a bi-weekly basis.

United Rentals General Rental Rates (Change Y/Y)M Science

United Rentals General Rental Rates (Change Y/Y)M Science

We expect rate trends to more meaningfully improve in Q2’21 against much easier year-ago comparisons and an expected seasonal lift in rental rates that was absent in 2021.