The rental industry faced unprecedented challenges in 2020, with the economic impact of COVID-19 driving a long pause in construction activity and acutely impacting markets dominated by travel, hospitality, and oil. The subsequent impact on rental operators was pronounced, but unlike prior downturns, pressure on equipment rental rates was generally modest in comparison. Rental houses focused primarily on pruning their fleets to conserve cash and adjust to the lower demand environment.

As we enter 2021, trends across our datasets – which include volume, rental rates, and used equipment inventory levels – suggest activity is picking up and that the worst has already passed for many operators. After identifying insights based on near real-time data, we’ve summarized the top three trends that affected the rental industry in 2020 and what we are watching for in 2021.

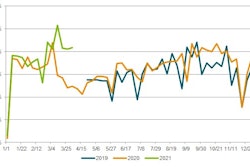

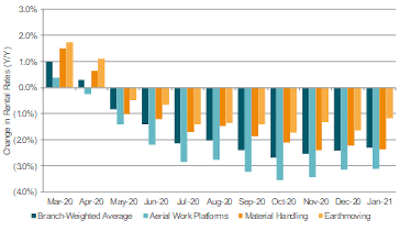

Declines in Rental Rates Peaked, Trends Improve in Early 2021

Rental rate levels started off strong in 2020 with rates at United Rentals tracking up ~1% Y/Y in our data.* However, the economic impact of the pandemic resulted in softening rate trends beginning in April, which proceeded to weaken before ultimately bottoming out at -2.7% Y/Y in October. While challenging, the decline in rates was largely comparable to the pullback observed during the oil downturn in 2016 and significantly above the 12% Y/Y decline United Rentals reported in 2009.

Ultimately, we believe the performance demonstrates the discipline and advancements made across the rental equipment market over the past decade, which has been characterized by consolidation, increased price transparency, and a much greater use of data across both small and large operators.

Following the low point in October, general rental rate data has broadly rebounded, and price declines have moderated. While easier year-ago comparisons are the driving force behind the moderation in declines, January data highlighted a sequential pick up in rental rates for earthmoving equipment (+0.4% M/M) – the first sequential increase noted in our data since H1’20.

2021 Outlook: We expect declines in rental rates on a year-over-year basis will continue to moderate through the first few months of the year, and ultimately, we will look to see if pricing can turn positive by early summer.

United Rentals General Rental Rates (Change Y/Y):

Source: M Science

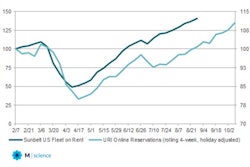

Digital Reservation Volumes Suggest Fleet Utilization Improving Heading into 2021

At M Science, we track online reservation volumes at United Rentals as a barometer for underlying fleet on rent. Please note, due to the growing share of online orders over time at United Rentals, trends in our online reservations data typically outpace underlying volume growth on a Y/Y basis.

In 2020, we saw digital reservations meaningfully contract at the onset of the pandemic, with April data falling 14% below levels observed in February. These drops were significant even accounting for historical seasonality and didn’t see a return to pre-pandemic levels until June. Encouragingly, volume trends accelerated through the second half of 2020, with Q3 reservations increasing 2% Y/Y and data in Q4 improving 6% Y/Y. Robust activity levels were registered in October as well.

2021 Outlook: A key theme of 2021 will be the cadence of recovery in volume of fleet on rent across the industry. Activity levels through mid-January are tracking up ~2% Y/Y, modestly slowing from trends in Q4, but improving from flat Y/Y growth in our December data. Indications from United Rentals suggest we could see volumes remain tempered against challenging year-ago comparisons in Q1’21, before accelerating through the remainder of the year.

United Rentals Weekly Online Reservations Index vs Sunbelt’s Reported U.S. Fleet on Rent:

Source: M Science

Disciplined Fleet Management in 2020 Provides Encouraging Outlook for Capex in 2021

In the wake of the pandemic, operators were quick to pullback on capital expenditures (particularly in the spring of 2020). Many downsized their fleets to help manage free cash flow and equipment utilization levels in a challenged demand environment. At United Rentals, we observed an immediate spike in used equipment listings in April (+$70M), which continued to increase until ultimately peaking in July at ~$950M of equipment listed for sale.

This quick and disciplined approach to fleet management appeared to have paid off in two ways: 1) by helping to support better rental rate pricing through the downturn, and 2) expediting the pace of fleet right-sizing to adjust to current demand levels. Since July, trends have largely improved – mirroring the pick-up observed in our digital reservation data – with used equipment listings declining on a month-over-month basis in H2’20 and ultimately declining for the first time in our data history in Q4’20. This suggests the market had neared equilibrium. United Rentals echoed this sentiment on their Q4’20 earnings call, suggesting the market had almost reached a “balance” early in 2021.

2021 Outlook: Another key theme to watch in 2021 will be the extent and cadence of which rental houses focus on fleet expansion. United Rentals is already suggesting a significant year of spending ahead with guidance for equipment capex to increase 108% to 139% Y/Y in FY’21. We will be closely monitoring used equipment for-sale inventory levels for evidence of continued market balance.

United Rentals Used Equipment Listed for Sale:

Source: M Science

*Please note we began collecting rental rate data in March 2019, and only have year-over-year comparisons beginning in March 2020.