Heavy-duty trucks market size is estimated to surpass $160 billion by 2024, according to a new research report by Global Market Insights, Inc.

Increasing domestic and international trading activities across the globe will significantly propel the heavy duty trucks market size over the forecast period. Road and rail lead the freight transport unit enhancing the overall business growth.

Upsurge in fleet size will positively support the logistics and construction sectors, which in turn will drive heavy-duty trucks market share. Growing demand for heavy commercial vehicles used in agricultural and mining applications with improved transmission will further support the product penetration.

Innovative connectivity based business models are revolutionizing the product demand by enhancing safety, reducing the cost of ownership and improving the convenience level of owners. Thus, propelling the heavy-duty trucks market size from 2017 to 2024.

Development of road network coupled with rising global sourcing of vehicle components will support the product demand. Several manufacturing companies are focusing on enhancing the profit margins by relying on customers from logistics and construction applications over the forecast timespan.

Stringent government protocols pertaining to emission control with the requirement for replacing the old vehicles will further fuel the product sales. Majority of the customers rely on the core values of offering products along with high quality, safety and environmental care features. Products offering higher power required by the applications will boost the overall heavy-duty trucks market growth.

Rise in labor cost, particularly in several emerged economies, coupled with fluctuation in the raw material prices may act as a restrain to the industry growth. Furthermore, economic uncertainty in several European countries may hamper the business expansion.

In 2016, class 5 contributed to over 12% of the overall industry share in terms of volume. This can be credited to superior features including wide usage in construction and logistic sectors. Furthermore, sturdy development in the manufacturing, particularly from emerging countries, is anticipated to further support the industry growth.

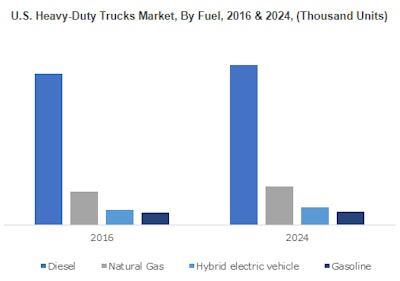

Natural gas will generate demand at over 160,000 units in the heavy-duty trucks market by 2024. Improved fuel efficiency and growing preference toward low emissions will support the industry expansion. Rising number of natural gas filling stations coupled with superior mileage offered by the product will propel the industry demand.

Logistics segment is anticipated to witness a substantial growth rate with a rate of 4.9% up to 2024. Increasing orders for new lorries due to enhanced recovery of equipment manufacturers from tumbling freight market will support product penetration. Bulking up of new orders and specialized balance in inventory levels will positively impact the heavy-duty trucks market size.

Asia Pacific is projected to register the maximum revenue share over the forecast timeframe due to the increasing production across the region, particularly in emerging economies including China and India. High availability of cheap labor and raw materials will foster heavy-duty trucks market growth across the region.