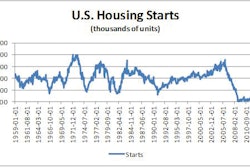

It's no secret that construction equipment dealers were especially hard hit during the recession, with machine sales declining as much as 60% at its peak. Dealers desperate to unload inventory collecting dust on their lots were willing to cut deals – even to the point of losing money – just to get the equipment off their books.

Such is no longer the case. The construction equipment market has seen a resurgence, as rental companies and construction firms alike move to replace aging equipment fleets. Forecasts indicate ongoing growth in U.S. equipment sales, with wheel loaders, backhoe-loaders and rubber-tracked loaders leading the charge.

Global demand for construction equipment is expected to continue its upward momentum, as well. A recent report predicts the market to reach $192.3 billion by 2017, up from $143.6 billion in 2012. Continued economic expansion in Asia (led by China, of course) and South America will push global demand to heightened levels over the next five-year period.

Construction equipment manufacturers are currently addressing this demand with their existing production capacity and workforce where possible. But as orders continue to grow, it will be increasingly difficult for manufacturers and their suppliers to keep pace. With few ready to commit to expanding either their capacity or employee base, lead times for equipment orders will lengthen, hindering the ability to get new equipment onto jobsites in a timely manner.

Costs for equipment will also migrate upward, stemming from the expanding demand, the introduction of more advanced technology (including Tier 4 Final solutions) and rising steel, rubber, fuel and other material prices. The bargain basement prices of the recession are history, and fewer and fewer "deals" will be had in the months ahead.

Evaluate Equipment Acquisition Options

So where does this leave contractors looking to replenish their equipment fleets?

At this point, equipment prices are more likely to go up than down, and availability of new machines will start to shrink. With interest rates still at extremely low levels, and Congress including a $500,000 asset write-off in its fiscal cliff legislation, construction firms seeking to add equipment within the next 12 months need to evaluate the best timing, and manner, to obtain it.

If capital allows, consider moving new equipment purchases forward to maximize availability and avoid future increases in pricing and/or interest rates. If availability of capital is uncertain, consult your local dealer about financing options (e.g., rent to own) that could make a particular unit more affordable, yet still enable you to take advantage of tax write-offs.

The used equipment market continues to be a viable option to obtain newer units at a reduced cost. However, demand has driven up used pricing for certain equipment types to levels that flirt with the line between new and used. As such, it's important to compare the costs of new vs. used carefully – particularly given that buying used carries the risk of inheriting problems not readily visible at the time of sale.

Rental is an effective alternative for non-staples in your fleet, or to fill a temporary need for a particular size class or type of machine. As rental companies renew their inventories, the availability and reliability of rental units is improving, enabling you to obtain the newer equipment you need without the much larger expense of a purchase. You also eliminate the cost to maintain the machine. On the other hand, rental rates are also rising steadily. Contracting with your rental supplier as soon as possible will ensure both availability of equipment and steady rental rates.

As the economy improves and your business expands, securing the right equipment at the right time is essential to maintaining project timetables and profit margins. To guarantee the tools you need are there when you need them – and at a cost your business can afford – evaluate whether you should take the plunge in the near term, or take your chances on pricing and availability in the months ahead.