- Latest report says economic activity continues to be high.

- A rate of 62.7% means the economy is growing.

- The report cited a shortage of construction contractors as the top economic concern in the services sector in April.

- Due to high demand and shortage of supply of goods and services, pricing is experiencing inflationary pressures, which should be short lived.

- Construction experienced the highest price increases of all 18 services industries.

- The business activity index was at its highest since 1997.

Economic growth in April was strong, down only 1% from March’s record high of 63.7%, according to a monthly economic report.

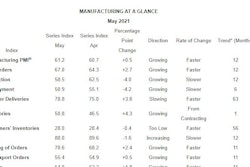

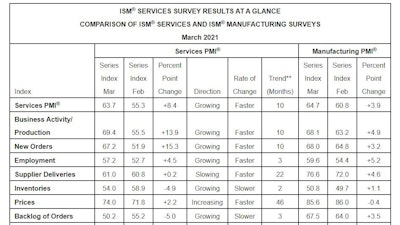

The Institute of Supply Management (ISM) issues monthly economic reports on the manufacturing and services sectors based on surveys with executives in those industries.

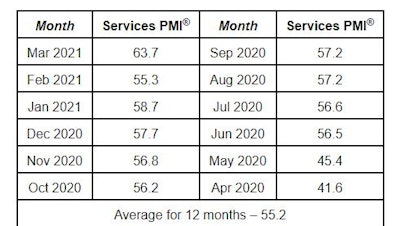

A recent historical glimpse of the Services PMI.ISM®

A recent historical glimpse of the Services PMI.ISM®

In its latest report, economic activity in the services sector registered at 62.7% in April, marking the 11th consecutive month of growth. Any number above 50% indicates a healthy economy, while a rating above 60% indicates economic growth, says Anthony Nieves, chair of the ISM Services Business Survey Committee, who delivered the Services ISM Report on Business results on May 5.

"There was slowing growth in the services sector in April, however, the rate of expansion is still strong,” he says. “Respondents’ comments indicate that pent-up demand is continuing. Production-capacity constraints, material shortages, weather and challenges in logistics and human resources continue to affect deliveries, which has resulted in a reduction of inventories."

Out of the 18 service industries tracked in the overall report, construction reported the fifth-most growth. The industries reporting growth, in order, are: arts, entertainment and recreation; wholesale trade; mining; management of companies and support services; construction; agriculture, forestry, fishing and hunting; accommodation and food services; real estate, rental and leasing; transportation and warehousing; public administration; finance and insurance; utilities; health care and social assistance; professional, scientific and technical services; information; retail trade; educational services and other services.

Watch ISM's Semiannual Economic Forecast video from April with CEO Tom Derry (don't be fooled by the first slide, the presentation is from April 2021):

Record-breaking Business Activity

The ISM Business Activity Index broke records in March, coming in at the highest level since 1997. The index was 69.4%, an increase of 13.9% points from February. Survey respondents attributed the boost to pent-up demand and increased spending, as stimulus checks were issued and pandemic lockdown rules were easing.

"We believe there is some pent-up demand starting to come back as back-orders and production ramp up after COVID-19 delays,” one respondent reported. “We also think there is purchase optimism due to the recent stimulus package."

The 17 industries reporting an increase in business activity for the month of March, in order, are: arts, entertainment and recreation; mining; management of companies and support services; accommodation and food services; wholesale trade; agriculture, forestry, fishing and hunting; real estate, rental and leasing; utilities; finance and insurance; public administration; transportation and warehousing; health care and social assistance; construction; information; retail trade; educational services; and professional, scientific and technical services.

Labor Shortage

It's no surprise that construction is short on workers. What is likely a surprise to many, though, is how much of a problem the labor shortage is to the services sector.

Nieves says that the biggest issue survey respondents mentioned in March was the lack of workers available for the construction industry, and as a secondary issue, a shortage of workers for restaurants and food service.

"Labor shortages in construction are an ongoing issue," he says. "Employment numbers could be stronger if we had the labor pool."

Commodities listed as in short supply are construction contractors at No. 1, followed by exam gloves, integrated circuits, general labor, construction labor, temporary labor and needles and syringes.

One survey respondent in the construction industry said they are turning down work because of the shortage.

“Consistent with the past year, labor continues to be the biggest issue we are facing,” the survey respondent said. “Finding and retaining labor, skilled and unskilled, is highly challenging and frustrating. As the challenges continue, we are not accepting all the work that we could if we had the labor.”

RELATED:

- What Workforce Challenges Are Ahead for Key Construction Industry Segments?

- Weak March US Construction Spending Rebound Masks Nonresidential Construction’s Struggles

- Manufacturing Index Remains Historically High for April

- Nationwide Study Shows Construction Optimism Up

- Employee Appreciation Throughout the Busy Season

Watch this CONEXPO video from 2014, where Brian Turmail, then-executive director of public affairs with Associated General Contractors of America, boils down the worker shortage and how to help solve it:

Pricing Pressure

Nieves says prices are experiencing some inflationary pressure, as there are increases in demand and constraints in supply. He expects that pressure to level off as more workers return to the labor force as pandemic restrictions loosen and stimulus and unemployment payments end. He cited a recent inflation report from the Federal Reserve that also predicted a quick turnaround for inflationary pressure.

“Prices are very strong,” he says. “There is a demand increase that is affecting pricing, but we expect a leveling off.”

According to the ISM report, the price index of 74% in March is 2.2% higher than the 71.8% reported in February. Construction experienced the highest price increases of all 18 services industries.

Listed in order are the services industries reporting the highest increases in prices paid in March: construction; wholesale trade; utilities; mining; real estate, rental and leasing; management of companies and support services; public administration; retail trade; transportation and warehousing; finance and insurance; other services; accommodation and food services; agriculture, forestry, fishing and hunting; health care and social assistance; arts, entertainment and recreation; professional, scientific and technical services; educational services; and information.

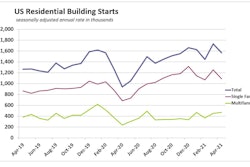

According to one survey respondent in the construction industry, "residential new home construction demand continues to outpace supply. Building material delays, discontinuations and shortages are beginning to develop. Shipping delays at the L.A. and Long Beach ports have contributed to longer lead times. Cold weather in has hurt several component manufacturers for building materials. We have encountered the 'perfect storm' for building material shortages and price increases."

Supply and Demand

Several services industries reported that business challenges due to shipping delays.

One respondent from the agriculture, forestry, fishing and hunting sector said, “delays in container deliveries are now impacting our business.”

The Supplier Deliveries Index registered at 61%, which is 0.2% higher than the 60.8% reported in February. A reading above 50% indicates slower deliveries, while a reading below 50% indicates faster deliveries.

One survey respondent reported, “logistics challenges, port delays, shipping delays, [and lower] part availability” and "it is still difficult to find trucks for loads and to secure shipping containers.”

The 14 industries reporting slower deliveries in March, listed in order, are: wholesale trade; agriculture, forestry, fishing and hunting; mining; transportation and warehousing; construction; real estate, rental and leasing; arts, entertainment and recreation; management of companies and support services; health care and social assistance; utilities; other services; information; professional, scientific and technical services; and public administration.

“Supply has been dwarfed by demand [and] ocean-transport logistics imbalances with ships and containers,” said one survey respondent in the professional, scientific and technical services industry. “North America parcel carriers swamped with volume-processing constraints, and highway carriers can’t supply drivers, regardless of choked original equipment manufacturer [OEM] truck orders. Rail intermodal is only competitive among two dozen or so origins, to about as many destinations.”

ISM® inventories graph.ISM®

ISM® inventories graph.ISM®

Inventories

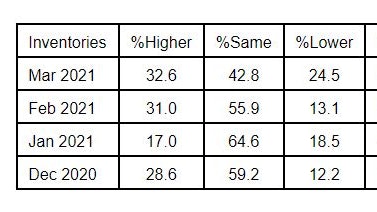

The Inventories Index grew in March for the second consecutive month, after a month of contraction in January. The reading of 54% was a 4.9% decrease from February.

Of the total respondents in March, 46% indicated they do not have inventories or do not measure them.

Comments from respondents include, "inventories remain fairly steady, [but] building inventory when and where possible to mitigate supply chain risks, such as supplier plant disruptions, carrier-related delays and the upcoming holidays," and "inventories are higher to meet increased demand, as well as hedge against lead-time inconsistencies for strategic items."

The nine industries reporting an increase in inventories, listed in order, are: finance and insurance; transportation and warehousing; other services; utilities; wholesale trade; construction; information; management of companies and support services; and educational services.