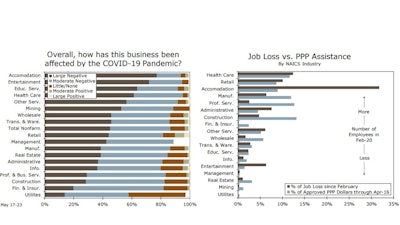

Coronavirus containment efforts disproportionately impinged on the service sector, but the largest share of initial Paycheck Protection Program dollars actually went to the goods-producing sector (mining, construction and manufacturing), which accounts for 26% of the dollars borrowed.

These industries are hurting and likely in need of financial support, Wells Fargo Economics says in an analysis of Census Bureau data. But consider that the leisure and hospitality sector (accommodation and entertainment), arguably the hardest-hit industry accounting for 38% of the jobs lost since February, only received about 10% of the dollars borrowed from the initial phase of PPP funding. More plainly, the leisure and hospitality sector lost more than three-times more jobs than the goods sector, but received less than half the amount of funding.

For Main Street businesses specifically, the “other services” industry – which includes many the same services and businesses you see on a walk down Main Street in America: churches and civic organizations, barber shops and beauty parlors, auto repair places and car washes, and laundromats and dry cleaners – received just 5% of the initial PPP funding.

“Other services” accounted for only a small share of total jobs lost since February (6%) but lost nearly a quarter of its total jobs over the past two months, which is the most of any major industry after leisure and hospitality. Thus, there appears to have been a mismatch between jobs lost and assistance received in the initial phase of the program.

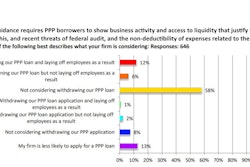

It is too soon to say if this will remain true of the second round of funding, as industry-specific data are not available from the Small Business Administration (SBA). Survey evidence from the Commerce Department, however, shows a majority of small businesses reported having tapped the PPP as of May 23. Nearly 75% of small businesses have requested financial assistance from the program and 69% of businesses have received a PPP loan. Main Street businesses were even more interested in securing access to these funds with 80% of “other services” seeking PPP funding and 72% of these businesses receiving the funds they need.