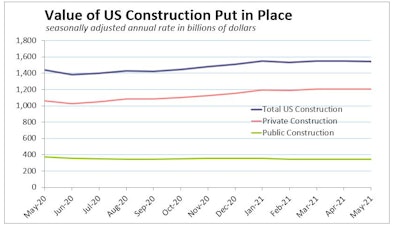

Slowing spending on single-family residential construction allowed a surprise slip in total May U.S. construction spending. Groups of economists surveyed by The Wall Street Journal and Reuters ahead of the Department of Commerce’s Thursday release of construction spending data had forecast 0.4% to 0.5% gains in the value of construction put in place for the month, but the seasonally adjusted annual rate for total construction slid 0.3% instead.

Strong, but slowing, housing growth

Residential spending did edge up 0.2% over the month. But much greater growth rates for the titanic housing construction segment – consistently averaging above 2.5% in the last half of 2020, and above 1.5% this year – have kept overall construction spending rising. Spending on single-family projects rose 0.8% during May, while multifamily outlays were unchanged. Home improvement spending sunk 0.6%.

“Home building remains strong, but the pace of improvement has moderated in recent months as shortages of building materials have led to soaring material costs and project delays,” says Mark Vitner, senior economist at Wells Fargo Securities in his analysis of the release of the monthly government estimates. “Lumber futures contract prices have come down sharply over the past few weeks (more than 30% in June), which is the first indication that there is a light at the end of the tunnel in terms of material price pressures. The slide in prices should boost new home construction and renovation spending during the second half of 2021. Lumber futures contract prices are still elevated relative to pre-pandemic norms, however, and it will take some time for those price declines to flow through to builders, contractors and DIYers.”

Residential construction spending year-to-date (not seasonally adjusted) soars 23.4% above the pandemic-beleaguered first five months of 2020, attributable almost exclusively to spending on single-family housing.

Nonresidential continues to struggle

“At the onset of the (COVID-19) crisis, residential construction comprised 41% of total construction spending. That proportion is now up to 49%,” says Associated Builders and Contractors Chief Economist Anirban Basu, commenting on the recent months of nonresidential construction spending decline. Nonresidential construction slid 0.7% in June, and is down 8.6% year-to-date compared to the same period of 2020.

Spending fell in 11 of the 16 nonresidential subcategories in June and is down significantly, if not dramatically, year-to-date in every category except sewage and waste disposal. Private nonresidential spending fell 1.1% in May, while public nonresidential construction spending declined 0.3%.

Public-sector peculiarities

Public outlays dropped 0.2% in May. A solid 1.4% increase in highway and street spending was not enough to outweigh declines in transportation and education expenditures, which both fell 1.9%.

Public spending should rebound significantly if Congress and the White House can bring home key elements of the infrastructure package that President Biden and a bipartisan group of senators just agreed on. The bill includes $559 billion in new spending on physical infrastructure and would total more than a trillion dollars in spending over eight years.

Nonresidential construction’s struggle precedes the pandemic. Reuters reports today that business investment on nonresidential structures has declined for six straight quarters.

“Interestingly, while a number of private construction segments are struggling under the dislocating impacts of the pandemic, public nonresidential construction has actually declined more rapidly than the private sector over the past year,” Basu points out. “With many state and local governments experiencing much better financial conditions than anticipated a year ago, public construction spending can be expected to improve going forward. However, anticipated improvement may be delayed by the specter of still-high construction materials prices, which may induce many project owners to postpone the onset of construction. Construction worker shortages are also deeply problematic, further exacerbating costs at a time of sluggish industry recovery.”