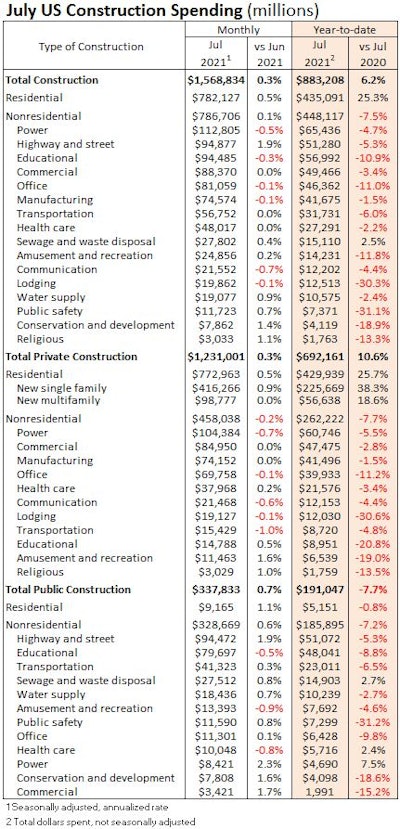

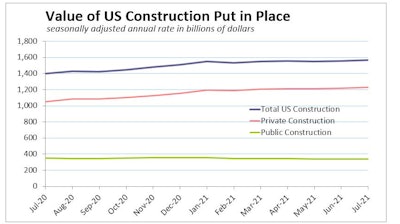

The total value of U.S. construction put in place in July crept up 0.3% on 0.5% growth in residential spending. Nonresidential construction spending was nearly flat, up just 0.1% on growth in public projects, according to data published today by the U.S. Census Bureau. That 0.1% was nonresidential construction’s second monthly gain over the past six months.

Year-to-date, the construction industry would be suffering dramatically if not for the gobsmacking 25.3% growth in residential spending. By contrast, nonresidential spending has tumbled 7.5% compared to the first seven months of 2020. Click on this table for a larger viewdata: US Department of Commerce; table: ForConstructionPros.com

Click on this table for a larger viewdata: US Department of Commerce; table: ForConstructionPros.com

Nonresidential is 'meaningfully worse'

July spending was down in six of 16 nonresidential subcategories. Spending in three more subcategories did not change. Private nonresidential spending was down 0.2% for the month, while the value of public nonresidential spending rose 0.6% in July.

“The nonresidential construction spending numbers are meaningfully worse than they initially appear,” said Associated Builders and Contractors’ Chief Economist Anirban Basu. “While the headline number suggests that nonresidential spending was effectively flat in July, the figure does not adjust for inflation. In real terms, the volume of construction services delivered by the nation’s nonresidential contractors declined in July.

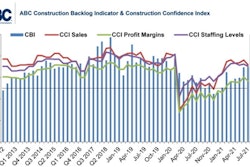

“Higher materials prices and worsening skills shortages represent primary culprits,” said Basu. “Many project owners are delaying projects due to elevated construction service delivery costs. With COVID-19 continuing to wreak havoc on supply chains, materials prices and transportation costs are set to remain elevated well into 2022. The result is that the construction recovery is significantly slower than it would otherwise be, a fact reflected in the most recent reading from ABC’s Construction Backlog Indicator.”

Nonres wins

Public outlays on highway and street projects rose 1.9%, while power (+2.3%), commercial (+1.7%) and conservation and development projects (+1.6%) saw sturdy gains as well.

Mark Vitner, senior economist at Wells Fargo Securities says many state and local governments are buoyed by federal stimulus programs. “Gains seen in public infrastructure-related outlays likely reflects spending of these funds, which should continue to support public spending throughout the year.”

Sluggish private-sector nonresidential categories were weighed down by continued losses in office and lodging spending. The surge in infections by COVID-19’s Delta variant delaying Americans’ return to the office has added uncertainty about the future of office construction. Lodging development is down more than 30% year-to-date. “Although leisure travel has strengthened, business travel will not likely return in a major way until at least early next year,” says Vitner.

“One notable standout (in nonresidential spending) is warehouse spending, which is up 13.8% year-over-year. Growth in online retailing and the desire by more businesses to hold more inventory are helping drive demand for space.”

Private healthcare (+0.2%) and educational (+0.5%) spending also saw modest increases, while religious (+1.0%) and amusement & recreation (+1.6%) projects posted sturdy gains.

“Demand for suburban office space has strengthened since the pandemic began,” says Vitner. “The market was oversupplied prior to pandemic, however, which has resulted in mostly remodeling projects as of late, which provide much less of a boost to construction spending. There are plenty of new suburban office projects in the pipeline, but many developers are having a tough time sourcing materials, securing labor and estimating project costs.”

Residential phenomenon updated

All of July’s 0.5% gain in private residential outlays came from single-family construction. Home builders have been racing to catch demand but have been burdened by shortages of key raw materials and labor. “Strength in single-family spending and some upward revisions to all three residential construction categories (single-family, multifamily and improvements) suggest that residential investment did not fall as much as previously thought and might lead to a small upward revision to Q2 real GDP growth,” Vitner notes.

Spending for home improvements edged lower in July but remains close to its all-time high reached in May.

Apartment construction is also holding up well, although multifamily outlays fell nominally in July (less than 0.1%). “Demand for apartments has been surprisingly strong, with rents surging in rapidly growing parts of the South and Southwest,” says Vitner. “Rents have risen faster than income, leading to a shortage of affordable apartments for workers earning the median income in many areas.” data: US Department of Commerce; graph: ForConstructionPros.com

data: US Department of Commerce; graph: ForConstructionPros.com