Construction spending inched down less than 0.1 percent in January, following a large upward revision in December and November, according to a new analysis of federal data by the Associated General Contractors of America. All forms of residential construction did well for the month and year-over-year, while private nonresidential spending was mixed and public construction declined amid continued congressional delays in passing a host of long-term infrastructure and tax measures.

“The strong gains in single-family homebuilding in December and January probably have a lot more to do with the unusually mild weather compared to year-ago conditions, than surging demand for new homes,” said Ken Simonson, the association’s chief economist. “Meanwhile, private nonresidential activity dropped after an exceptionally large jump in December, but the January total was still up an impressive 17 percent from a year ago.”

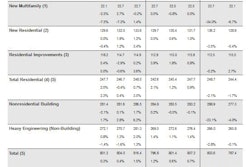

Simonson noted that private residential spending, which climbed 1.8 percent for the month and 6.7 percent compared with January 2011, was higher across-the-board. New single-family construction posted gains of 2.5 percent for the month and 5.5 percent over 12 months; new multi-family construction was up 0.7 percent and 20 percent, respectively; and improvements to existing residential structures moved up 1.3 percent and 6.4 percent.

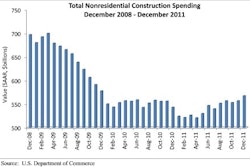

Private nonresidential spending was at the second-highest level since December 2009, despite the 1.5 percent pullback in January, Simonson noted. The largest private category, power construction—which includes shale-related activity as well as traditional and renewable electric power—dropped 1.8 percent in January but was up a robust 28 percent over 12 months. Simonson also cited large year-over-year gains for the next three-largest types: manufacturing construction (-5.9 percent for the month, +38.5 percent over 12 months); commercial—retail, warehouse and farm—construction (-1.0 percent for the month, +8.5 percent over 12 months); and health care construction (up 1.7 percent and 12.5 percent, respectively).

Simonson noted that public construction spending was nearly flat in January, declining 0.2 percent from December and 0.5 percent from January 2011. Highway and street construction, the largest public category, edged down 0.2 percent for the month but climbed 4.5 percent year-over-year, while other transportation spending—comprising transit, ports, airports and passenger rail—rallied 2.5 percent for the month but tumbled 10 percent from a year ago.

Association officials said that despite growing private sector demand, the construction industry was being held back by partisan gridlock in Washington. They said the fact that Congress has failed to enact a host of long-term infrastructure and tax measures was making it hard for many firms to make business investment and hiring decisions.

“Construction firms fear two things: declining demand and market uncertainty,” said the association’s chief executive officer, Stephen E. Sandherr. “Unfortunately, Washington’s failure to enact long-term investment and tax measures is delivering drop in construction activity and making it impossible for contractors to make investment, hiring and many other fundamental business decisions.”