Heavy equipment is expensive. Every organization using heavy equipment has to control costs and still provide the machinery required for their work.

For example, a privately owned construction company is growing and has just acquired new projects larger than any the company has done before. How does this company make sure it gets the new equipment needed without stripping its cash flows? This is a complex task requiring all the essential skills of heavy equipment fleet management.

There are many different options to acquire equipment and all of them have costs and risks to consider. The decision to buy, lease, or rent is dependent upon many factors specific to any given situation.

In the scenario described, the company's decision is made to buy equipment because the newly acquired projects are long-term, and the company expects to do similar projects in the future. However, the capital budget is limited and the equipment must be financed over time.

How can the construction company calculate total acquisition costs for purchasing equipment?

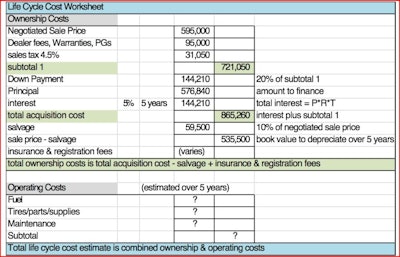

It’s more than just a matter of negotiating the sale price with the dealer. The Life Cycle Cost estimation worksheet shown above presents an example of the factors an equipment manager must consider and how the total acquisition costs of financed equipment add up.

How can the construction company compare lending options and find a lender to rely upon? What documentation will a responsible lender require? The company has this exciting growth opportunity and needs this equipment. Why does the lender want to charge a higher interest rate?

While business growth is exciting, it often means strained cash flows. “Cash flow management for a rapidly growing, bootstrapped company can be harder than the world’s most difficult Sudoku puzzle. It’s almost a full-time job staying on top of who owes you what and who you owe, and then prioritizing those payments. All the while, you’re pushing for more growth, but with that comes additional expenses,” says Vinny Antonio, president of a rapidly growing start-up.

Working with lenders

The construction company should research lenders by name and look for online customer reviews. The construction company should request the lender’s references, then contact those references. If another party refers a particular lender, ask why they specifically recommend this lender. It is always good practice to check the lending company by name with the Better Business Bureau (bbb.org).

Consider the lender’s perspective and need to manage risk. Just as the construction company has to consider whether the benefits of its projects outweigh the risks of performing them (risk management), the lender has to consider the same questions. Will the benefit of lending money to the construction company outweigh the risks? Will this rapidly growing company have the cash flows to make the payments?

To determine their risk, lenders will ask for specific company information. When applying for financing, the company should have their financial statements and company history, and expect to fill out an application. For larger transactions, three years of financial statements, two years of company tax returns, as well as the last three years of personal financial statements and tax returns of company owners or guarantors, plus an interim statement for the most recent month-end may all be required. This documentation will help the lender see the company is fully prepared for the application process.

The construction company should work closely with the lender to realistically forecast the company’s equipment needs. For example, the lender may want to know how the equipment will be used and how long will it last? How does the company estimate equipment hours and utilization? How does the company calculate internal cost recovery rates? How does the company take care of its machines?

The construction company's Certified Equipment Manager (CEM) is the key resource who can provide realistic estimates of how each machine will be used and maintained. A good CEM has real-world experience in heavy equipment specifications, procurement, price negotiation on equipment and financing, lifecycle cost analysis, financial management, risk management, parts management, preventive maintenance, benchmarking, safety, human resources, and environmental regulations.

Armed with that knowledge, the CEM can discuss the company's growth and equipment hour estimates, as well as document the company’s compliance with safety, environmental and HR regulations—all of which can demonstrate to the lender that the company will not face legal penalties that could hamper regular loan payments.

When getting ready to close the financing deal, the construction company’s CEM should read the final lease or loan documents, and never assume the final details are the same as those in a proposal. The CEM should ask for copies of contracts ahead of time to review them before signing, then make sure to get counter-signed copies after signing.

A solid, proactive, preventive maintenance program and good financial forecasting can help convince a lender that the company can handle the demands of growth.