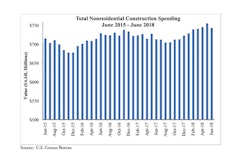

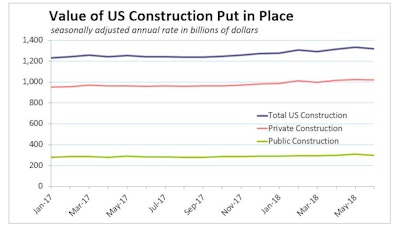

The value of construction put in place in the U.S. surprised forecasters with a 1.1% drop in June to an annual rate of $1.3 billion. With its estimates of June construction spending, the Department of Commerce revised its May figures up to a record high, and spending in all five of the largest construction sub-segments suffered in comparison the following month.

Notably, spending on educational construction plunged 9.3%, and the immense private residential construction category slipped 0.5%.

Monthly spending estimates are volatile and prone to substantial revision. Observing the change in year-to-date spending tells a story more consistent with the month following a spending record.

Total U.S. construction spending through the first half of the year has leapt 5.1% above the first six months of 2017. Private residential spending year to date is soaring 8.3% above the same period of 2017, and Top 5 nonresidential segments, highway and street and commercial construction are 4.2% and 4.8%, respectively, better than last year.

Keep in mind, though, that year-to-date spending in the No. 1 and No. 4 nonresidential construction categories – power and educational – are flat (power: -0.4%, and educational: 0.0%). Manufacturing construction, roughly equal in size to spending on multifamily housing, has plunged 8.7% since the first of the year.

“Extended overall economic growth should remain supportive to the construction sector in the second half of the year,” according to analysis of the monthly construction spending estimates by the Wells Fargo Economics Group. “That said, rising interest rates, higher material costs and labor scarcity will continue to challenge the construction sector.”

Nonresidential Construction Spending Dips Nearly 2% in June

Private residential spending year to date is soaring 8.3% above the same period of 2017, and Top 5 nonresidential segments, highway/street and commercial construction are 4.2% and 4.8%, better than last year.

Private residential spending year to date is soaring 8.3% above the same period of 2017, and Top 5 nonresidential segments, highway/street and commercial construction are 4.2% and 4.8%, better than last year.

The Department of Commerce revised its May figures up to a record high, taking some of the sting out of June's declines.

The Department of Commerce revised its May figures up to a record high, taking some of the sting out of June's declines.