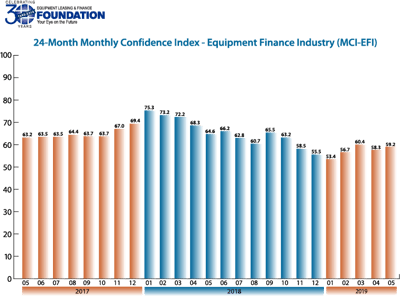

The Equipment Leasing & Finance Foundation has released the May 2019 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market improved in May to 59.2, up from the April index of 58.3.

This month marks the 10th anniversary of the MCI-EFI, which was launched in the wake of the 2008 recession to provide industry participants with greater insight and context for industry statistics and performance.

When asked about the outlook for the future, MCI-EFI survey respondent Michael DiCecco, executive managing director, Huntington Asset Finance, said, “Our customers continue to be generally positive, delivering solid business performance and investing in equipment. Should that sentiment continue, I believe the equipment finance industry will have another good year.”

2019 Outlook Expects 2.2% GDP Growth, 4.5% Rise in Equipment/Software Spend

“The domestic economy continues to remain strong with most indicators at strong positions," David Normandin, CLFP, president and CEO, Wintrust Specialty Finance, agreed. "Our volume has been strong, and confidence of our customers has remained positive."

However, he added, "We are sensitive to industry portfolio performance and stress, and therefore, are cautiously optimistic about the remainder of 2019.”

Others added to this note of caution. While optimistic about low unemployment and the pace of new car purchases, Quentin Cote, CLFP, president, Mintaka Financial, LLC, noted, "I am concerned that trade wars will create pockets of economic hardship, such as alternative energy and agriculture, and that the issues will spread to related industries.”

Michael Romanowski, president, Farm Credit Leasing Services Corporation, appears to share concern about the potential impacts of the latest round of tariffs. “We are beginning to see producers and agribusinesses make capital investments after years of belt tightening," he commented. "Activity has picked up but continues to be challenged by low commodity prices and uncertainty over trade tariffs.”

May 2019 Survey Results

The overall MCI-EFI is 59.2, an increase from 58.3 in April. Following is a breakdown of survey results:

- When asked to assess their business conditions over the next four months, 16.1% of executives responding said they believe business conditions will improve over the next four months, up from 13.3% in April. 67.7% of respondents believe business conditions will remain the same over the next four months, a decrease from 76.7% the previous month. 16.1% believe business conditions will worsen, an increase from 10% in April.

- 16.1% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 13.3% in April. 77.4% believe demand will “remain the same” during the same four-month time period, a decrease from 83.3% the previous month. 6.5% believe demand will decline, up from 3.3% who believed so in April.

- 12.9% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 6.7% in April. 87.1% of executives indicate they expect the “same” access to capital to fund business, a decrease from 93.3% last month. None expect “less” access to capital, unchanged from last month.

- When asked, 41.9% of the executives report they expect to hire more employees over the next four months, a decrease from 46.7% in April. 45.2% expect no change in headcount over the next four months, an increase from 40% last month. 12.9% expect to hire fewer employees, down from 13.3% last month.

- 51.6% of the leadership evaluate the current U.S. economy as “excellent,” up from 40% in April. 48.4% of the leadership evaluate the current U.S. economy as “fair,” a decrease from 60% the previous month. None evaluate it as “poor,” unchanged from April.

- 9.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 6.7% in April. 77.4% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 73.3% the previous month. 12.9% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 20% in April.

- In May, 35.5% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 36.7% last month. 64.5% believe there will be “no change” in business development spending, an increase from 63.3% in April. None believe there will be a decrease in spending, unchanged from last month.