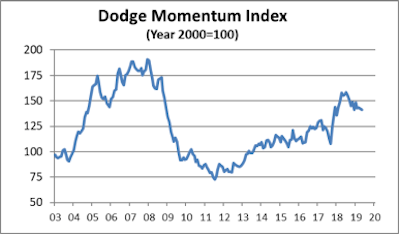

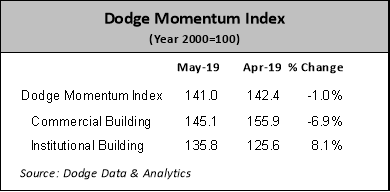

The Dodge Momentum Index fell 1.0% in May to 141.0 (2000=100) from the revised April reading of 142.4. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The May decline for the Momentum Index was due entirely to a 6.9% drop by its commercial component, as its institutional component rose 8.1%.

In May, there were 14 projects each with a value of $100 million or more that entered planning. The leading commercial projects were a $500 million office building in the Bronx NY and the $300 million second phase of the Iceberg Towers in Burbank CA. The leading institutional projects were the $250 million second phase of the Kaiser Permanente Hospital in Sacramento CA and the $150 million Moffitt Cancer Center Hospital in Tampa FL.

Dodge Momentum Index Dips in April on Falling Commercial Component

April US Construction Starts Drop 15% on Nonbuilding, Nonresidential Slide