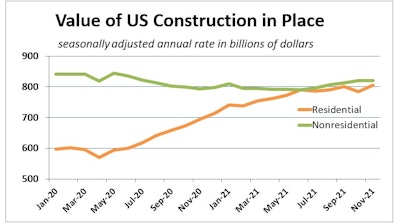

The value of all construction put in place in November rose 0.4%, with residential spending increasing 0.9%, and nonresidential spending remaining unchanged during the month. The U.S. Census Bureau data for the prior two months were revised higher, including a substantial increase in September. Total construction spending for the first 11 months of 2021 is 7.9% greater than the same period of 2020. data: US Department of Commerce; table: ForConstructionPros.com

data: US Department of Commerce; table: ForConstructionPros.com

Strong home-buyer demand in the continuing shortfall of homes for sale is maintaining home builders’ positive momentum. Spending on single-family construction and home improvements rose 1.2% and 0.9%, respectively. But multifamily spending declined 0.3%.

A nonresidential pause

The Associated Builders and Contractors analysis of the Census data points out that spending increased for the month in seven of the 16 nonresidential subcategories, with spending in the commercial and office subcategories unchanged. Private nonresidential spending was up 0.1%, while public nonresidential construction spending declined 0.1% in November.

“If no news is good news, then this was a fine report,” said ABC Chief Economist Anirban Basu. “There is little in the data for November 2021 that was earth-shattering. It is interesting to note, however, that the streak of meaningful monthly increases in nonresidential construction spending effectively ended in November, strongly suggesting that supply chain issues and worker shortages continue to constrain the pace of recovery in nonresidential construction (the same issues that continue to suppress contractor margins, according to ABC’s Construction Confidence Index).”

“Supply constraints continue to wreak havoc on project timelines and are adding to the rising cost environment,” said Mark Vitner, senior economist with Wells Fargo Securities. “For example, the Producer Price Index (PPI) for construction materials and components jumped 1.5% during November.”

Year-to-date strength in notable nonresidential segments such as commercial and manufacturing construction but are outweighed by the year’s big plunge in educational construction. Construction at educational institutions had carried a lot of momentum through the initial pandemic year of 2020, but faded as uncertainty extended into 2021.

“Among all segments, the one experiencing the largest year-over-year decline is public safety,” said Basu. “During the pandemic’s early stages, spending in this category grew rapidly as America prepared for a public health crisis. That dynamic reversed itself in 2021. The other category suffering a major decline in construction spending over the past year is lodging.

“With business travel still slow to return and the omicron variant wreaking havoc on airlines, occupancy will remain subpar for months to come, limiting the pace of construction spending recovery in this segment. The nonresidential construction category experiencing the largest year-over-year growth in spending is manufacturing, a reflection of the ongoing efforts of producers to expand supply to meet demand.”

Public spending backtracks

“Total public expenditures backtracked 0.2% during November,” said Vitner. “Highway and street spending, which is the largest category of public spending, fell 0.8%. Public educational expenditures rose 0.3% during the month.

“Public sector construction will likely be a growth area over the next few years,” Vitner suggested. “State and local governments are now replete with cash from strong tax receipts and federal aid. Looking further ahead, the recently enacted Infrastructure Investment & Jobs Act provides new spending for roads, bridges, mass transit, water and numerous other infrastructure projects, although much of the impact will not become apparent for a year or more.

“Construction appears set to strengthen next year. The forward-looking Architecture Billings Index (ABI) declined to 51 in November, however the monthly reading marks the 10th consecutive month when the index has been in expansion territory.” data: US Department of Commerce; graph: ForConstructionPros.com

data: US Department of Commerce; graph: ForConstructionPros.com