Caterpillar Inc. released its fourth-quarter and full-year 2020 results late last week, with both reflecting changes in dealer inventories and decreased end-user demand – presumably due to the COVID-19 pandemic's impact on the global economy and outlook – that drove sales and revenues downward.

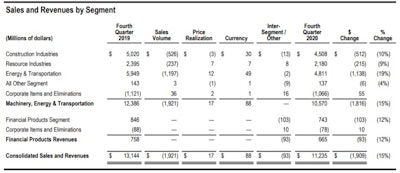

The company reported sales and revenues for fourth quarter 2020 of $11.2 billion, down 15% compared to the $13.1 billion reported in Q4 2019. Sales were lower across the company’s three primary segments, with the largest decline in Energy & Transportation (-19%). Construction Industries’ total sales were $4.508 billion in the quarter, a decrease of $512 million, or 10%, compared with $5.020 billion in Q4 2019, with Caterpillar noting its dealers decreased inventories more during Q4 2020 than in the same quarter in 2019. The third primary business segment, Resource Industries, fared only slightly better, declining 9% for the quarter.

Operating profit margin came in at 12.3% in the quarter, dipping modestly from 14.1% in Q4 2019. Fourth-quarter profit per share declined from $1.97 in Q4 2019 to $1.42 in Q4 2020. Adjusted profit per share for the quarter was $2.12, compared with $2.71 in fourth quarter 2019. Even given the decline, the company indicated Q4 2020 adjusted profit per share reflects strong operational performance and a lower effective tax rate during the period.

For full year, sales and revenues fell from 2019’s $53.8 billion to $41.7 billion in 2020, a decline of 22%. The company again attributes the 2020 sales and revenues decline to lower end-user demand and dealers reducing their inventories by $2.9 billion.

Operating profit margin for 2020 was 10.9%, down nearly 5% from 2019’s 15.4%. Full-year profit fell by nearly half to $5.46 per share in 2020 compared with $10.74 per share in 2019. Adjusted profit per share in 2020 was $6.56 compared with $11.40 in 2019.

Enterprise operating cash flow remained strong at $6.3 billion in 2020. During the year, the company paid dividends of $2.2 billion and repurchased $1.1 billion of Caterpillar common stock. It indicates its liquidity continues to be solid, with an enterprise cash balance of $9.4 billion at year’s end.

In a statement, Jim Umpleby, Caterpillar chairman and CEO, applauded his team's efforts given the difficult circumstances 2020 presented. “I’m proud of our global team’s continued resilience in safely navigating COVID-19 while continuing to provide the essential products and services the world needs,” he stated. “Our fourth-quarter and full-year results reflect the team’s agility in a challenging environment while executing our strategy for long-term profitable growth. We achieved the adjusted operating profit margin established during our 2019 Investor Day while continuing to invest in products and services. We are well-positioned for the future and will emerge from the pandemic as an even stronger company.”