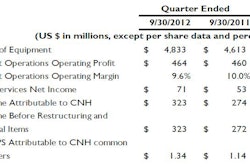

Terex Corp. reported income from continuing operations of $30.2 million, or $0.27 per share, for the third quarter of 2012, an 18 percent drop compared to income from continuing operations of $36.9 million for the third quarter of 2011.

Excluding costs associated with the debt repayments and certain other items in the quarter, income from continuing operations as adjusted in the third quarter of 2012 was $0.62 per share. Excluding the gain on the sale of Bucyrus International shares and certain other items, income from continuing operations as adjusted in the third quarter of 2011 was $0.30 per share.

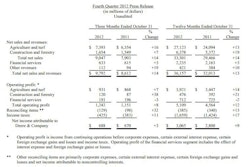

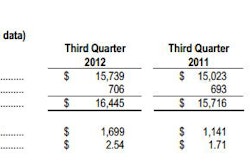

Net sales were $1,822.0 million in the third quarter of 2012, an increase of 1.0% from $1,803.6 million in the third quarter of 2011. Excluding the impact of the acquisition of Demag Cranes AG, net sales decreased approximately 8%, of which 5.4% relates to foreign currency fluctuations, from the comparable prior year period. Income from operations was $131.9 million in the third quarter of 2012, an improvement of $79.3 million when compared to income from operations of $52.6 millionin the third quarter of 2011. Excluding the impact of certain items in the third quarter of 2012, income from operations as adjusted was approximately $140 million. Excluding the impact of certain items in the third quarter of 2011, income from operations as adjusted was approximately$78 million.

"Our earnings this quarter are in line with our expectations, and reflect our continued focus on price discipline and cost containment," said Ron DeFeo, Terex chairman and CEO. "The mix of performance was varied, with our Cranes, Aerial Work Platforms (AWP) and Material Handling & Port Solutions (MHPS) segments achieving favorable results, while the results of our Construction and Materials Processing (MP) segments showed some softening. Overall, we remain optimistic that the end markets for many of our products will continue to improve."

"Continuing strength in many of our markets, combined with our persistent focus on margin improvement, cash generation, and the integration of our MHPS segment, provide us with continued confidence for favorable long term growth and profitability," DeFeo continued. "However, macro events have created some near term softening of demand and uncertainty for our Construction and MP segments. In addition, order timing and seasonal order patterns have impacted our AWP segment on a near term basis. This is apparent in the backlog for these segments."

"We now expect full year 2012 sales of approximately $7.5 billion and hold constant our full year earnings per share outlook for 2012 of $1.95 to $2.05, based on an average share count of approximately 114 million shares and excluding the impact of debt repayments, restructuring and unusual items."

"We do not view this near term uncertainty as evidence of a protracted slowdown," DeFeo added. "We will remain focused in 2013 on margin improvement and cash generation, as well as the integration of MHPS into our global team. When combined with approximately $44 million in reduced interest expense associated with recent debt repayments and re-pricing, we expect 2013 to be a year of moderate top line growth along with meaningful improvement in earnings per share and return on invested capital."