Sales of construction equipment by the world's 50 largest manufacturers grew just 2.6 percent last year to US$186 billion, according KHL Group’s annual Yellow Table survey. This was a record for the industry, but the low growth rate was indicative of weak conditions in 2012.

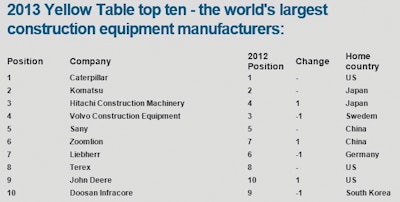

The Yellow Table, which is a ranking of the world's 50 largest construction equipment manufacturers, saw relatively few changes at the top of the table, with the industry's long-standing number 1 and number 2, U.S.-based Caterpillar and Japan's Komatsu, continuing to hold the positions they have had for well over a decade.

Further down the top 10, Sany remained China’s largest equipment manufacturer, in 5th position globally, while Zoomlion overtook Liebherr to claim the number 6 spot. Terex remained at number 8, while at number 9, John Deere has swapped places with Doosan, which was 10th in this year’s Yellow Table.

Outside the top 10 there were some more significant moves. At number 12, Metso Mining and Construction was the industry’s largest specialist manufacturer, with increased sales from its portfolio of crushing and screening equipment taking it up three places, compared to the previous year’s rankings. In fact it was a good year for other specialists, with powered access and telehandler maker JLG, which is owned by Oshkosh, rising four places to number 17 and crane builder Manitowoc moving up two to number 18.

The weak growth figure of just 2.6 percent was attributable to falls in revenues for China’s equipment manufacturers. Their share of total revenues fell from 16.9 percent in 2012’s survey to 15 percent – equivalent to U.S. $27.9 billion. It was the first time in the 10-year history of the Yellow Table that China’s share of the top 50’s revenues has fallen. This drop equated to a loss in absolute terms of some U.S. $2.7 billion year-on-year, again a first for China’s construction equipment manufacturers.

As a result, six out of the nine Chinese manufacturers listed in the Yellow Table slipped down the rankings last year, and one company listed in the 2012 edition dropped out of the top 50.

The report’s author, Chris Sleight, said, "Weak market conditions in China last year were clearly a decisive factor for the global industry last year. Despite the string of acquisitions we’ve seen from some of China’s key manufacturers, overall revenues still fell, although the largest groups – Sany, Zoomlion and XCMG managed to maintain their standings. Fortunately the strength among North American manufacturers was enough to offset this and deliver some growth.”

Rankings based on revenues from construction equipment sales in U.S. Dollars in 2012.

The Yellow Table is available to buy from KHL’s information store, www.khl-infostore.com, either as a report on single years, or as a multiannual study.