Equipment and software investment growth is likely to reach 3.9% in 2019, according to the latest update to the 2019 Equipment Leasing & Finance U.S. Economic Outlook. This is a pullback compared to the Q2 update published in April, which forecast 4.5% growth for the year.

The slowdown comes after two consecutive years of solid growth. According to the update, business conditions for the equipment finance industry softened in the first half of 2019 on weakening in the U.S. manufacturing sector. Investment growth in several key verticals was also expected to slow or contract in the second half of the year.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is included in the report, tracks 12 equipment and software investment verticals. In addition, the “Momentum Monitor Sector Matrix” provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength.

One of the verticals tracked is construction machinery investment. The Investment Momentum Monitor indicates that growth in this vertical is likely to weaken further over the next three to six months, and potentially stall. Mining and oilfield machinery investment growth, on the other hand, is expected to remain steady during the same period. Agricultural machinery investment growth will likely remain modestly positive, and materials handling equipment investment growth is likely to weaken and may turn negative. All other industrial equipment investment growth will likely weaken and may stall.

One factor further influencing the current slowdown is consumer sentiment. "Consumer confidence has eased this year, while consumer spending has moderated," said Jeffry D. Elliott, chairman and senior managing director, Huntington Equipment Finance. "Large businesses are showing signs of pulling back, though small businesses remain upbeat."

Yet, on the whole, the economy remains on track to expand. "In light of stronger-than-expected growth in Q1, the economy is expected to grow 2.5% in 2019, up from the previous estimate of 2.2%," Elliott noted.

Other highlights from the Q3 update:

- Capital spending slowed in the beginning of 2019. Business investment faces further downside risk if the industrial sector continues to fade, and trade relations remain turbulent. Although banks continue to tighten lending standards to consumers amid waning credit demand among businesses and consumers, overall credit market conditions remain mostly healthy. Financial stress remains relatively low by historical standards, though delinquencies and charge-offs are on the rise.

- After achieving 2.9% growth in 2018 — tied with 2015 for the strongest year of growth of the current business cycle — the U.S. economy expanded at a healthy 3.1% pace in the first quarter, exceeding expectations. However, trade frictions are undoubtedly contributing to the softness in the U.S. manufacturing sector, which continued to struggle in Q2 and does not appear to be on the verge of a rebound.

- Though domestic oil production has been a key bright spot for the U.S. economy and the increasingly dovish Federal Reserve has helped buoy financial markets, there are several risk factors that merit close attention. Risks include the efficacy of China’s efforts to stimulate its economy, the divergence between small- and big-business optimism, and the potential for a protracted slowdown in consumer spending later this year.

For further insights, see the video highlights below:

Monthly Confidence Rebounds But Concerns Remain

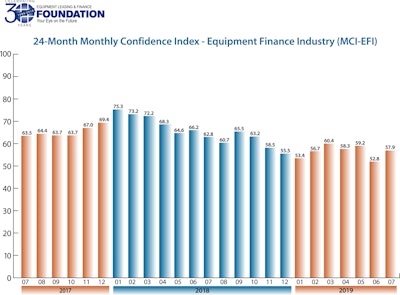

While the U.S. Economic Outlook showed signs of easing, overall confidence in the equipment leasing and finance sector saw a rebound in July, climbing to 57.9 from the June level of 52.8, according to the Equipment Leasing & Finance Foundation July 2019 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI).

Designed to collect leadership data, the Monthly Confidence Index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

Ten percent believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from none who believed so in June. Nearly 87% believe demand will “remain the same” during the same period, an increase from 83.3% the previous month, and just 3.3% believe demand will decline, down from 16.7% who believed so in June.

Ten percent of respondents expect improved access to capital to fund equipment acquisitions over the next four months, a decline from 13.3% in June. The majority of executives (90%) expect the “same” access to capital to fund business, an increase from 86.7% last month. None expect “less” access to capital, unchanged from last month.

When asked to assess the overall U.S. economy, 41.4% of the leadership evaluate it as “excellent,” up from 40% in June; 58.6% evaluate it as “fair,” an increase from 56.7% the previous month; and none evaluate it as “poor,” down from 3.3% in June. Eighty percent believe the U.S. economy will "stay the same" over the next six months, up from 70% the previous month. Just 6.7% believe U.S. economic conditions will get “better” (up from 3.3% in June), while 13.3% believe economic conditions in the U.S. will worsen, a decrease from 26.7% in June.

When asked about the outlook for the future, MCI-EFI survey respondent David Normandin, CLFP, President and CEO, Wintrust Specialty Finance, said, “The metrics remain solid for the U.S. economy and specifically small business lending. Our application volume continues to grow and conversion rates are strong. The inherent risk in the portfolio continues to be good and performance continues as it has been, with extremely low defaults.

"My concerns continue to be overly aggressive credit quality and pricing in the overall market," he continued. "These historically are the indicators of challenges to come, and therefore we remain focused on these metrics in our business.”

Quentin Cote, CLFP, president, Mintaka Financial, LLC, is optimistic based on low unemployment, which should lead to increased wages and consumer spending that will continue to drive the economy. However, he cautioned, "I’m concerned about delayed impacts of trade wars negatively affecting product prices and stanching demand for capital and consumer goods.”

Michael Romanowski, president, Farm Credit Leasing, echoed these concerns. “Our customers continue to be challenged by low commodity prices and uncertainty over tariffs,” he noted. “This is impacting decisions regarding large capital investments, which is muting our growth opportunities.”

“Demand is stable but the types of transactions we are seeing are not for business expansions; they are more replacement equipment deals," Valerie Hayes Jester, president, Brandywine Capital Associates, pointed out. "The mood I sense is a concern that the economy may be at its peak and a decline may commence in the second half of this year. This type of sentiment usually means a weakening in demand for finance.”