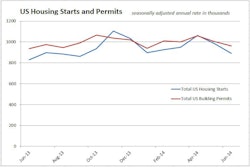

Peter Coy, writing in Bloomberg Businessweek’s global economics section, says recent measures of housing activity are reason to call off the housing-bubble alert.

U.S. house prices rose in 2012 and 2013 at a pace as extreme as anything seen during the disastrous housing bubble of the last decade. But Coy says CoreLogic’s measurement of house-price growth dropping below double digits, to 8.8%, from May 2013 to May 2014 is a healthy correction.

“The housing market is fundamentally sounder than it has been in years,” Coy writes. “The number of homes entering foreclosure per quarter is back down to the pre-crisis levels of 2005-2006, notes Torsten Slok, chief international economist of Deutsche Bank Securities. Distressed home sales accounted for only 11% of sales in May, down from 18% a year earlier.”

Capital Economics, CoreLogic and Barclays predict that average housing prices will continue to rise at eminently sustainable mid to high single-digit percentage rates for the coming year.

Supporting his upbeat outlook on housing, Coy points out the history demonstrating that home buying is more sensitive to the health of the job market than to interest rates. Today’s June jobs report by the Bureau of Labor Statistics – showing that the U.S. economy added over 200,000 jobs for the fifth consecutive month – should be very encouraging news indeed.

Peter Coy's The Re-Explosion of U.S. House Prices Is Over